‘Risks elevated’: APRA holds banks’ mortgage rate buffer at 3pc

APRA said an uncertain economy, geopolitical instability, high household debt and inflation remain key risks for banks, compelling it to keep the loan buffer intact.

Author: Hugh Dive

Australian Banks and the Widow Maker Trade

First Published on Firstlinks – Link Here

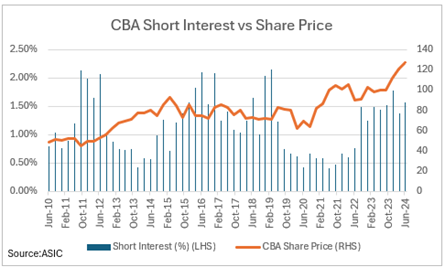

Several times in the past twelve months investors have been offered dire warnings from well-regarded bank analysts that the share prices of the major Australian bank stocks were over-valued and headed for a big fall and that prudent investors should sell all of their bank shares. These warnings were echoed in the financial press as CBA’s share price pushed through $130 per share and questions why Australian banks should rank among the most valuable global banks based on market capitalization. While the current sell all banks call in 2024 is based on valuation grounds, this trading advice has been given regularly by the investment banks, most recently in 2020 (Covid-19 will see unemployment spike and house prices crash) and in 2022 (fixed interest rate cliff).

For an institutional investor one of the most difficult decisions, one faces is how much of the portfolio should be allocated to Australian banks. Currently, the Australian banks account for 22% of the ASX 200 or 24% when Macquarie is included, following strong profits, large share buybacks, and low bad debts across their mortgage portfolios.

In this week’s piece we are going to look at look at the change in the lists of the most valuable global banks over time. Generally appearing on these lists results in subsequent share price underperformance and raises the question whether the Australian banks are headed for a fall.

A Look Back in Time

Looking back at the lists of the largest banks in 2015, 2005, 1995, and 1985, the banks that dominated these lists generally performed very poorly in the following decade. In the early 1980s four of the top 10 banks were French, all of which were later nationalised by the Mitterrand government.

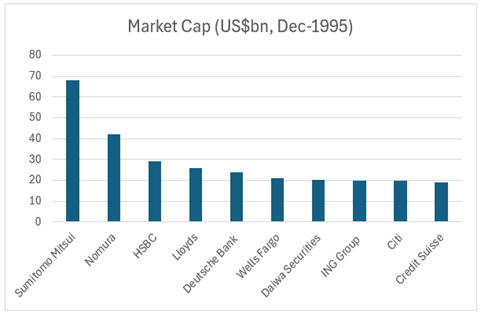

By 1995 the French banks had all fallen off the list, which was now dominated by Japanese Banks like Sumitomo Mitsui, Nomura and Daiwa. These banks were viewed at the time to be taking over the world as Japanese investors bought up assets from the Rockefeller Centre to Gold Coast apartment blocks. The bursting of the overheated Japanese asset price bubble resulted in massive non-performing loans and several Japanese banks’ failure.

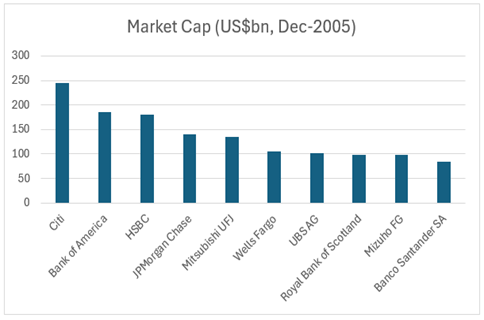

The chart above shows the list of the top banks by size as of December 2005. The list was dominated by US and European banks, as investors wanted exposure to innovative banks whose expertise at structuring complex financial products seemed to generate a stream of very strong profits with minimal risk. The financial crisis 2007-08 brought on by the bursting of the US housing bubble was very unkind to these banks, with the bulk of them being forced to seek state bail-out packages to ensure their solvency. Indeed, the largest bank on the list, Citibank, has a share price that currently sits -85% below what it was in December 2003, thanks to a dilutionary bail-out that saw the US taxpayer take a 36% equity stake in the bank.

The high-flying Royal Bank of Scotland’s (8th largest bank in 2005) fall from grace was sharper than most with its share price falling 96% between 2007 and 2008 and was bailed out by UK taxpayers in 2008. The combination of the poor acquisitions of Dutch bank ABN Amro, £15 billion in fines and legal costs and £40bn in losses from bad lending, sees the the state still owning 22% of the bank and its market capitalization 80% below what it was in 2005.

Moving on Five Years

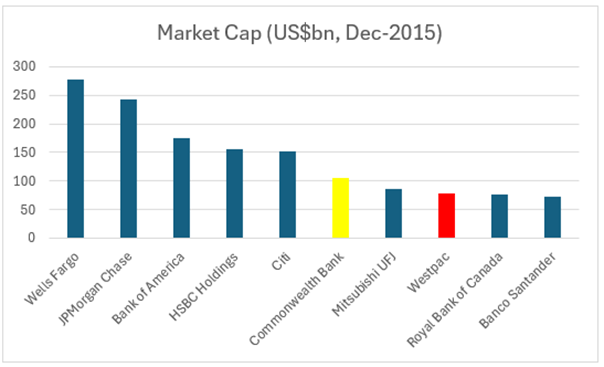

In the below graph, we can see that in 2015, USA banks dominated the top five largest banks in the world, but this is where we saw a rise from the Australian Banks (Commonwealth Bank and Westpac), HSBC and a Canadian bank (Royal Bank of Canada) break into the top 10 largest banks in the world. Canadian banks operate in a similar regulatory and economic environment to Australian banks, as well as deriving a large majority of their revenues from mortgages. In Canada, six large banks (RBC, TD, Scotiabank, MBO, CIBC, NBC) control around 93% of the market similar to the Australian Big Four. The leader from 2005 Citi still remains on the list, though has shed $100 billion in market capitalization during the 10-year period.

There is an argument that in decade to 2015, HSBC along with the Australian and Canadian banks didn’t grow into the top 10 banks in the world, but rather, other banks self-destructed around them or were still recovering from the global financial crisis.

What Happens Next?

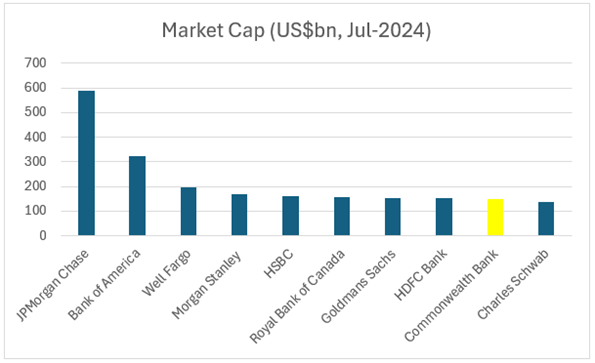

Looking back, owning the largest and most loved banks in 1985, 1995, and 2005 proved to be a poor investment decision in the following decade. However, the 2015 list has many names that remain the largest banks to 2024, but in different rankings.

Most of the biggest banks in the world are from the US, with the US banks deriving less than half of their profits from mortgages, with most coming from other arms of the banks. The remainder of the list is made up with from Canada (RBC), India (HDFC) and Australia’s CBA. Interestingly none of the Australian banks are considered by the Financial Stability Board (FSB) to be globally significant banks, despite CBA (market capitalisation A$216 billion) being significantly larger and more profitable than the globally significant Deutsche Bank (market capitalisation A$44 billion). Consequently in July 2024 many investors are calling the Australian banks, especially CBA overvalued and that investors should short sell the major banks.

The Widow-Maker Trade

A “Widow-Maker” trade in the hedge fund world is a short-selling of an overvalued asset that may make sense intellectually, but the share price continues to rise in spite of the bearish investment thesis. As it continues to rise, the short seller is forced to post ever-increasing amounts of cash into their margin account, increasing the chance that the fund manager has a heart attack or gets fired.

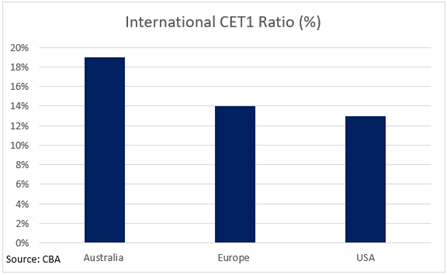

US and European fund managers have been systematically shorting Australian banks based on the seductive story that they are overvalued compared to their domestic peers. International investors have historically made mistakes by thinking Australian banks operate in the same regulatory environments as their domestic banks. The basis for their thesis is that four banks from a small backwater in the financial world have little business, being amongst the largest in the world.

How Aussies Banks are Different from Global Banks

The big four Australian banks control around 75% of the domestic lending market and enjoy higher barriers to entry due to the high level of regulation placed on them. Conversely in the USA there are over 4,000 registered commercial banks, with the top 5 (Wells Fargo, Bank of America, U.S Bank, JP Morgan Chase and PNC Bank) having a market share of only 7%.

While the number of banks in the USA sounds like a preferable market structure to the Australian banking oligopoly, this is only due to previous regulations that precluded banks from opening branches outside their home state. This results in a large number of small and often financially precarious banks with limited geographic diversification and can lead to frequent bank collapses such as Silicon Valley Bank in 2023. Conversely the last bank collapse in Australia was the State Bank of South Australia in 1991.

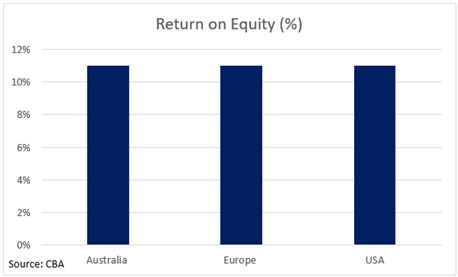

Additionally, the Australian banks are regulatory made to be better capitalized leading to lower loan losses through the cycle and are more consistent profitability than their US or European peers due to low impairment and provision charges.

Betting against the buybacks

Due to strong capital ratios built up post-banking Royal Commission through COVID-19, the big four Australian banks are now well capitalized and have begun large share buyback schemes. ANZ has announced a $2 billion buyback, a $1 billion CBA buyback, a $2 billion NAB buyback and a $2 billion Westpac buyback. For investors, this will support the share price over the short term with a buyer always being in the market every day to hold up the day-to-day share price. Not only will it support the share price, but it will also reduce the amount of outstanding shares to divide next year’s profit by.

The banks all normally commit to neutralizing their dividend reinvestment plans, which will see banks buy shares on the market and give them to shareholders instead of issuing new shares to shareholders. This may sound insignificant, but across the May 2024 dividend schedule, Atlas estimated $900 million worth of shares were bought to support the neutralization.

Our Thoughts

The Australian banks have successfully generated record profits from their domestic franchises, which have operated in a cozy banking oligopoly over the past decade. Recently, competition from non-bank lenders has increased due to the rise of private credit funds in this higher interest rate environment. Despite this increased competition, banks’ bad debts remain at all-time lows, and profits continue to be strong.

What caused the French, Japanese, and US banks to explode in the late 1980s, 1990s, and 2000s was rapid lending expansion into new areas that, in hindsight, their management teams did not fully understand. Australian banks have learnt from their previous mistakes around international expansion and are focusing on their domestic markets, in which the banks generally have a strong history of profitable business.

Whilst Australian housing can be viewed as expensive globally, Atlas sees a range of factors that strongly incentivize Australian households to maintain mortgage payments. These include recourse lending, homes being exempt from capital gains tax and a very strong cultural desire to own one’s own home, which means that bad debts should remain quite low. Although bad debts will remain low, banks are likely to see continued mortgage competition that will reduce their interest margins and profitability growth.

Although, CBA has diverged from its long-run price-to-earnings of 16x forward earnings to over 22 times, Atlas still believes that CBA will have a good result in August with the announcement of further on-market share buybacks. CBA is still the leader for the banks in marketing, technology, customer service, and quality of management and has the highest return on equity, but does it deserve this high of a premium?

SMH: Eight Stocks that analysts have tipped for a turnaround

Dogs of the ASX for the 2024 Financial Year – Livewire

Originally posted to livewire – Link Here

The past twelve months have been an improving story for investors; July to October was a brutal ride down, with global equity markets trading down in unison by close to 10% due to concerns around higher interest rates and higher oil prices. However, markets have rallied higher since much touted recessions have not materialised, and the Central Bank rate tightening has finished. Paradoxically, we are in an environment where negative economic data puts upward pressure on equity markets, as it is seen to bring forward the first round of interest rate cuts. Despite what feels like a bruising twelve months for investors, the ASX 200 has enjoyed a pretty good year, up +7.8% or (or +12.1%, including dividends).

The solid gain in the ASX 200 over the past year masks a large dispersion in returns, with financials, tech and retail companies posting solid gains, while energy and mining stocks have trod water. At year-end, many institutional investors cast an eye over the market’s trash to find some treasure to drive portfolio returns in the coming year. Invariably, several bottom-performing stocks will confound market expectations and stage remarkable comebacks! Unlike in previous years, the Dogs from June 2023 have not had a good year, with only one stock outperforming the ASX 200.

In this piece, we will examine the “Dogs of the ASX” in FY 2024, sifting through the market’s trash and look for treasure. We will also see how the 2023 Dogs performed, rate Atlas’ picks from 12 months ago, and examine the top-performing Dogs since 2010.

THE THEORY BEHIND THE DOGS OF THE DOW

Michael O’Higgins popularised a systematic investment strategy of investing in underperforming companies named “Dogs of the Dow” in his 1991 book Beating the Dow. This approach seeks to invest in the same manner as deep value and contrarian investors. O’Higgins advocated buying the ten worst-performing stocks over the past 12 months from the Dow Jones Industrial Average (DJIA) at the beginning of the year but restricting the stocks selected to those still paying a dividend.

Restricting the investment universe to a large capitalisation index like the DJIA or ASX Top 100 improves the unloved company’s chance of recovery in the following year.

Larger companies are more likely to have the financial strength or understanding capital providers (such as existing shareholders and banks) that can provide additional capital to allow the company to recover from corporate missteps or unfriendly economic conditions. Conversely, smaller companies in the Dogs of the ASX 200 from 2023, such as Lake Resources and Core Lithium, have been removed from the ASX 200 and appear to be fighting for their corporate lives.

RETAIL INVESTORS HAVE AN ADVANTAGE.

One of the reasons this strategy persists is that institutional fund managers often report their portfolios’ contents to asset consultants as part of their annual reviews. This process incentivises fund managers to sell the “dogs” in their portfolio towards the end of the year as part of “window dressing” their portfolio before being evaluated. Institutional fund manager selling of underperformers is especially prevalent in December and June of every year.

For example, in early July 2023, fund managers would have seen some pretty stern questioning from asset consultants about why they would have contractor Downer EDI in their portfolio after restating previously reported profits after overstating profits. Indeed, in early 2024, the company sued their auditor for failing to detect accounting irregularities created by my company executives!

Retail investors can afford to take longer-term views on the investment merits of any company that may have hit a speed bump, as retail investors are not swayed by asset consultants questioning short-term underperformance. Additionally, many underperformers see tax-loss selling around the financial year’s end, further depressing share prices in June. Often, the share prices of these underperformers rebound in the new financial year when this tax loss selling finishes and investors repurchase their shares.

ZEROS TO HEROES

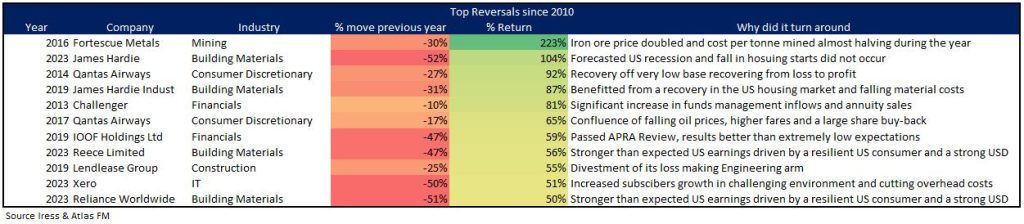

Over the past decade we have seen 11 companies stage share price returns turn around of greater than 50% over the twelve months after inclusion in the Dogs list for the prior year. Two companies, James Hardie and Qantas, have appeared twice. Miner Fortescue had the largest turnaround in 2016, adding over 200% after falling heavily in the prior year. 2015 saw company profits fall 88% on tumbling iron ore prices, and many in the market were concerned about the medium-term viability of Australia’s third iron ore miner, given debts of US$7.2 billion (despite no payments required until 2019). Sharply rebounding iron ore prices in 2016 saw a change in the miner’s fortune, with US$2.9 billion wiped from its debt pile and the company’s share price going from $1.74 to finish at $5.50.

Three common themes presented by the top reversal dogs have been:

1. Favourable moves in commodity prices – such as iron ore for Fortescue, building material costs for James Hardie, and low fuel costs for Qantas

2. Beating extremely low expectations – such as Challenger, Lendlease, Qantas and IOOF

3. Widely believed negative event does not occur – James Hardie, Reece and Reliance Worldwide all shined in 2023 when the expected US Recession and “Fixed Rate Cliff” in Australia did not occur.

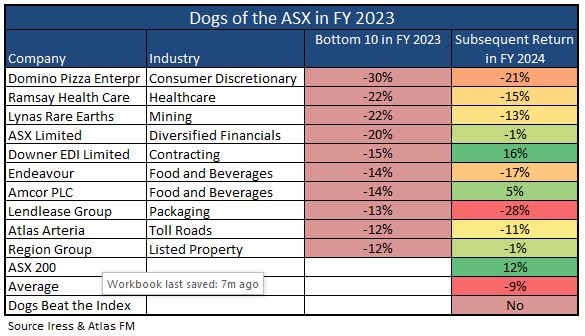

DOGS OF THE ASX IN 2023

Over the past year, the Dogs from 2023 fell -9% and underperformed the ASX 200 and marks the largest underperformance of the Dogs Portfolio since 2015. What was also notable in 2024 was that the “Dogs” contained no significant outperformers. This contrasts with last July where the Dogs not only outperformed the ASX 200, but contained four stocks that finished the year 20% ahead of the index!

From the table above, only one out of the ten “dogs” of 2023 outperformed the index. Contractor Downer EDI shrugged off the earnings restatements of 2023 and saw its share price grind slowly upwards, highlighted by a positive result in February reporting operational improvements, higher margins and a 1 cent increase in the dividend.

Conversely, the pain continued in FY24 for Domino’s Pizza, Lend Lease and Endeavour. Dominos has continued to underperform in Asia due to lower Christmas period sales and earnings across Japan, Taiwan, Malaysia, and France while continuing to close stores across Europe. Endeavour has continued to underperform due to tighter regulations around its gaming machines, which are a high-margin segment of the hotel business. Lendlease has continued to underperform due to its high profile but unprofitable international construction operations, though in May the company announced the staged sale of the international business and a $500 million dollar buy-back.

OUR PICKS FROM JULY 2023??

When making our picks twelve months ago as to which of the Dogs from FY 2023 would rebound over the coming year, Atlas’ class mark would be a “C” with the teacher’s comment “must try harder next year”.

We expected that Atlas Arteria’s share price would rebound on improving operational performance and that 22% shareholder IFM would make a bid for the company. While over the past year IFM have increased their shareholding to 27% and the company has delivered record earnings, but threats from Marine Le Pen’s National Rally (RN) party to nationalise French banks, tollroads, airports and dismantle existing wind turbines has weighed on the stock. Similarly, Amcor, despite rallying in May on a strong third quarter result, has weakened in June and has finished the year with only a small gain.

Somewhat more successful was our pick that ASX would struggle in 2024. This pick looked very poor up until March 2024 with the ASX rallying alongside equity markets, however the Exchange’s share price took a tumble in June after revealing ballooning expense growth and increasing capital expenditure to replace its CHESS settlement system.

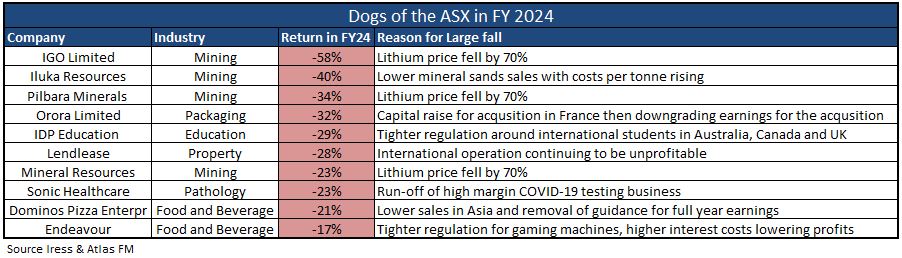

WHAT DOES THE CLASS OF 2024 LOOK LIKE?

Looking through the list of 2024 underperformers, there are many new faces on the list, with Dominos, Lendlease and Endeavour the only companies to have previously been on the list of ASX 100 Dogs over the past ten years.

The key themes in the list of Dogs for the financial year 2024 are:

1. Fall in commodity Prices – IGO, Pilbara Minerals and Mineral Resources

2. Questionable International Expansion – Dominos Pizza, Lendlease and Orora

3. Tighter Regulation – Endeavour and IDP Education

4. Self-Inflicted Wounds – Sonic Healthcare and Iluka Resources

OUR PICKS FOR FY 2025

Every year, three or four companies in the Dogs of the ASX look like a poor addition to an investor’s portfolio on July 1st but will significantly outperform the market over the following year. In selecting a share price recovery candidate for the next year, we generally look at companies whose current woes are company-specific rather than caused by factors outside the control of their management team, such as commodity prices or government policies.

A rebound in the lithium price will see a significant recovery in the share prices of IGO, Pilbara Minerals and Mineral Resources, but Atlas does not possess a crystal ball that says with certainty that this will happen. Similarly, changes in government regulations for foreign students and gaming machines have weighed on the share prices of IDP Education and Endeavour, respectively. Government regulation on gaming machines does not appear to be abating, and on the 1st of July, the government increased international visa fees by 125%, making Australia the most expensive country to apply for a student visa.

Domino’s Pizza has had a rough few years, with its share price falling from $160 in late 2021 to $35 in July 2024, which indicates that a share price recovery could be on the cards. However, the company still looks expensive, trading on a PE ratio of 27 times and a recovery reliant on rebuilding a sprawling global business, particularly in France, Japan and Taiwan. Due to our lack of familiarity with the pizza markets in these countries, combined with the cost associated with closing stores, we are not picking the discount pizza maker to rebound in 2025.

Atlas’ picks for a recovery in the next 12 months are both Sonic Healthcare and Lend Lease. Sonic Healthcare had a weak 12 months due to higher inflation and currency headwinds, which culminated in a downgrade in May. However, profits in FY25 are expected to increase to A$1.7- 1.75 billion based on organic growth and recent acquisitions in the USA, Switzerland and Germany. Sonic trades at a discount on its share price in July 2019, however since then the company has increased earnings by 60% (or A$600 million), reduced debt and improved the quality of the business.

Lend Lease in FY25 looks similar to Downer EDI over the past year, an out of favour company with very low expectations. If the company executes on its exit plans from the international business and conducts the announced $500 million buy-back its share price will rebound. Exiting Lend Lease’s glamorous but unprofitable international business will be an addition via subtraction for shareholders.