Takeover trend continues after a record 2021

Last year was a record for takeovers on the ASX. Tens of billions of dollars worth of takeover bids were announced during 2021 over a range of assets from airports (Sydney Airport), to electricity transmission (Spark Infrastructure and AusNet) to financial technology (AfterPay).

Blog

Buy, Hold or Bust …. Blue Chip Stocks

Mr Burns: Let’s have a look at my stock portfolio. Hmm. Confederated Slave Holdings. How’s that doing? Smithers, why didn’t you tell me about this market crash?

This calls for an aggressive trading strategy. Take 50% of my money and put it in the blue chips – Transatlantic Zeppelin, Amalgamated Spats… Congreve’s inflammable Powders, U.S. Hay… and sink the rest into that up-and-coming Baltimore opera hat company. That should set things right again, eh, boys?

Simpsons S08, Ep21 The Old Man and the Lisa

This week a colleague raised with me the investment strategy of buying a basket of well-known blue chip stocks and then consistently reinvesting any excess cash to buy more of those same shares. Blue Chip stocks are the large well-established household names, in the top 50 companies listed on the ASX, with a market value in the tens of billions. Stockbrokers recommend these companies to their clients based on the perception that they are safe and stable and following the axiom “Nobody ever got fired for choosing IBM”. They are viewed safe for advisors to recommend even if they fall in value.

However, like Mr Burns found out in this Simpsons episode, market conditions for once financially sound companies like Transatlantic Zeppelin and US Hay are not always permanent. The Hindenburg disaster of 1937 and the development of passenger airplanes eradicated the demand for slow moving flammable airships and penetration of motor cars permanently diminished the demand for horses as a form of transport and thus the demand for hay.

The leading companies of today will not necessarily look like the top companies in ten years’ time. Indeed, some of the top blue-chip companies from 2022 will almost certainly either see their value fall to a fraction of their current price or slide into administration in the coming years.

What is a blue-chip stock?

The term “Blue Chip Stock” was first used by Oliver Gingold of Dow Jones in 1923 and referred to high priced stocks. “Blue” was a poker reference, as in poker sets the highest value chip is traditionally the blue one. Since then, the term has come to denote high quality stocks, with consistent revenue growth and dominant market positions in their industry. These companies typically have a stable debt to equity/interest coverage ratio and generate superior return on equity (ROE). Over time this translates into a high market capitalisation that places a company in the Top 50 companies listed on the ASX. Currently the smallest stock (Lend Lease) in the ASX Top 50 has a market value of over A$7 billion.

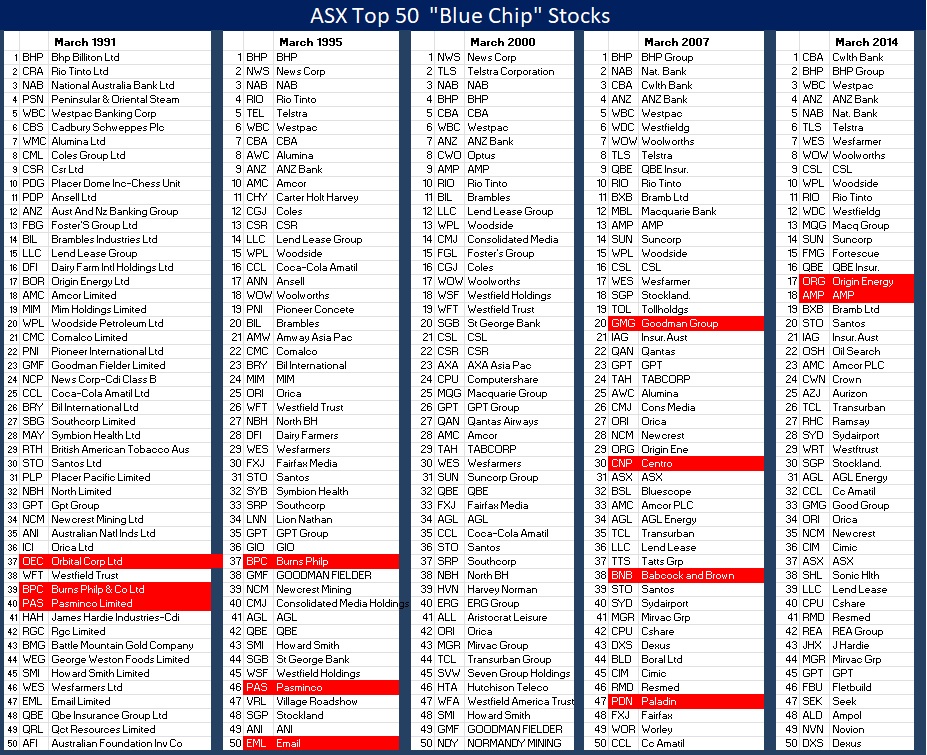

The below table looks at the Top 50 stocks on the ASX by market valuation at five points in time over the last 30 years. There are many familiar names such as BHP and Westpac that were considered blue chips in 1991 and retain that status today, but there are also many that would be unfamiliar to many investors today. Whilst most of these (Cadbury Schweppes, North Broken Hill, PNO, Dairy Farm Holdings) have disappeared from the share market due to being taken over by other companies, in each period there are a number of so called blue chips that either ultimately went into administration (Centro/Paladin/Babcock), faced catastrophic losses very soon after appearing (Goodman) or faded away to a small fraction of their previous size (AMP/Orbital Engine). The faded blue chips in the table are coloured in red.

Too much debt

In early 2007 shopping centre trust Centro Properties was riding high after making a string of acquisitions in Australia and the USA. It was viewed as highly innovative, dubbed the Macquarie Bank of Property Trusts due to its use of debt to create a global property empire. After acquiring a portfolio of 469 small shopping centres across 38 US states for A$3.9 billion, the trust was managing A$26 billion of property. As a result of the acquisition, Centro Properties upgraded its forecast 2008 financial year distribution growth to 19%. However instead of rising distributions, in December 2007 Centro Properties faced significant problems in refinancing US$5.5 billion of debt that was due in a very challenging market. Additionally, the shopping centre owner faced questions about the accuracy of their financial accounts after billions of dollars in short-term bridging debt was classified as long-term debt. As a result of asset write offs, Centro Properties in June 2009 reported a negative net tangible assets (NTA) of -$2.23 per share (it was trading at $0.16 per share at the time, down from a high of $2). Ultimately equity holders were essentially wiped out as the mountainous debt burden was converted into equity.

Origin Energy ended 2014 with a very high debt level due to the construction of a LNG export facility in Queensland which the company had difficulty paying back after energy prices fell heavily. While still a large company, Origin has been a poor investment since March 2014 underperforming the ASX200 by 112% due to a dilutive capital raise to pay down debt and dividends being suspended for several years.

Financial Engineering

In 1998 zinc miner Pasminco was one of the premier global zinc miners after buying the Century project from Rio Tinto. The company developed an audacious hedging strategy to lower debt costs by borrowing in USD and hedged the currency based on the expectation that the AUD would remain between US68c and US65c. Unfortunately, the AUD/USD fell to below 51c in 2001 at the same time that the zinc price crashed. This left the company with limited cash flow and losses on the hedge book that blew out to $850 million when the company went into administration in late 2001.

The combination of too much debt and financial engineering

No discussion of faded blue chips would be complete without looking at investment bank Babcock & Brown. At its peak in June 2007, the investment bank was lauded as a creative user of financial structuring and a fee-generating machine that propelled the company’s share price to $34.63, with a market capitalisation above $9 billion. From meetings that I had with Babcock & Brown management prior to the GFC, they also made no secret of the fact that only a small amount of their earnings could be characterised as “recurring” and that most of the profit (used to pay dividends) was generated by revaluing assets cannily acquired by the company.

Similarly, to Centro, Babcock & Brown both entered the GFC with too much debt and – more importantly – too much short-term debt that needed to be refinanced in a challenging market. In June 2007, the Babcock & Brown group had amassed $80 billion in assets, supported by $77 billion in debt, much of this held off balance sheet or characterised as “non-recourse” and held by satellite funds. The company collapsed in 2009 after a falling share price triggered debt covenants and the company was unable to refinance the debt due. Ultimately, in very complex liquidation proceedings the noteholders ended up receiving 2c in the dollar for bonds held and equity holders received nothing.

Technology that did not work as expected

The orbital engine was invented by Ralph Sarich in 1972 and at one time was expected to revolutionise combustion engines, with fewer moving parts and greater efficiency. In 1991, the future for Orbital – a company that owned the technology for orbital engines – looked bright and BHP took a 25% stake in the company. Despite this promise, a range of technical problems with cooling and lubricating the engine proved unsolvable and both the founder and BHP ran for the exits. Orbital still exists selling fuel injection technology and propulsion systems for drones, but with a share price of $0.29, which is a long way from its peak at $24.

ERG’s future looked bright 17 years ago and it was a glamour tech stock listed on the ASX offering smartcards for mass transit systems from Moscow to Manila. Whilst the technology itself was sound the company was effectively sunk, not by the offshore moves but by difficulties in implementing the ERG’s T-Card in Sydney and issues with the NSW State Government which led to the project being scrapped. Ultimately this resulted in lawsuits and the company was delisted in 2009.

Not recognising changing market conditions

For most of this century AMP was considered a blue-chip stock and arguably the premium and most trusted insurance and investment (or superannuation) brand in Australia, founded in 1849 and listed on the ASX in 1998. AMP’s vertical integration (the AMP branded adviser selling an AMP product to a client) model arguably made the company lazy, as it insulated AMP from external market competition. The 2018 Hayne Royal Commission exposed the flaws in this model and has seen advice, investment administration and investment management being unbundled. Since March 2014 AMP’s share price has fallen from $5 per share to 94c and the market capitalisation has dwindled from $16 billion to $3 billion.

What the Future Holds

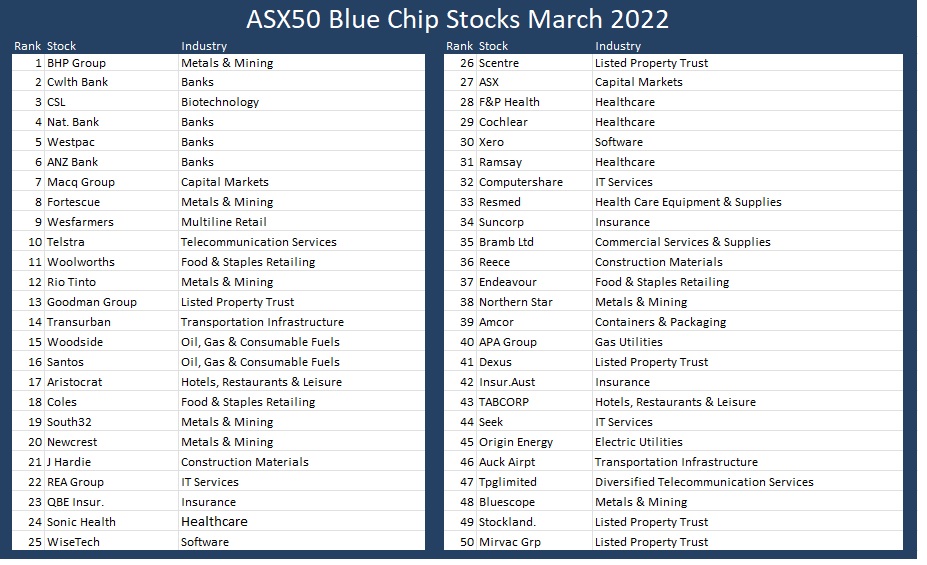

The above table shows the ASX Top 50 as of March 2022, ranked by market capitalisation. Whilst it is usually hard to identify at the time which leading companies will falter in the future, history strongly suggests that amongst this list there are one or two, currently considered blue chips that will either go into administration or slide back into insignificance. Below we identify some considerations that might influence the future fates of current blue chips:

High leverage

In March 2014 Fortescue looked like a candidate for a blue chip that might blow up, with 70% gearing resulting from $10.5 billion in net debt and the company looking to sell off infrastructure assets. However, a period of sustained high iron ore prices since 2019 has allowed the company to pay off $6 billion in debt and reduce gearing to a more manageable 23% in 2022.

Amongst the blue-chip stocks in the table above, the companies with the highest debt burden as measured by gearing (net debt divided by total equity) are APA Group (242%), Transurban (121%) and Ramsay Healthcare (75%). The key characteristic of these heavily geared companies is the view that the stable returns from airports, pipelines, toll roads and hospital procedures affords the ability to service high levels of debt.

Whilst these companies own wonderful assets and point to both the spread of debt maturities and their interest rate hedges (which lock in a portion of the company’s debt at a fixed rate), these hedges will expire and debt currently attracting low rates will almost certainly have to be refinanced at higher rates.

Technology does not work as expected

Whilst we do not consider this likely and believe that the company has instituted many safeguards, blood therapy company CSL does face the risk of product recalls through contamination. In 2008, CSL’s rival Baxter faced a product recall after 81 deaths were linked to tainted blood thinning drugs produced under contract in China, but sold in the US under Baxter’s name. Similarly medical device manufacturers Cochlear and Resmed face issues from Chinese competitors that consistently look to copy the intellectual property in their hearing and sleep apnoea devices.

Left Field

Miners BHP, Rio Tinto and Fortescue have all benefited greatly from a twenty-year construction boom in China, selling iron ore and coking coal to feed an army of blast furnaces, with most to all company profits coming from iron ore. In 2000 China produced 120 million tonnes of steel and imported around 100 million tonnes of iron ore. In 2021 imports of iron ore had grown to 1.1 billion tonnes of which 70% came from Australia.

Steel is primarily produced using one of two methods, either via a blast furnace or an electric arc furnace. Blast furnaces use iron ore, coking coal and limestone to produce iron, all of which are dug out of the ground in Australia and shipped to China. Electric arc furnaces produce steel by melting scrap steel with electricity. As an economy matures it starts creating a pool of scrap steel as the rebar in buildings and steel in cars is recycled. In 2021 only 15% of Chinese steel was produced using recycled scrap, whereas in the USA over 70% of steel is produced using scrap metal.

While there will still be demand for Australian iron ore, China will certainly start generating increasingly larger amounts of scrap steel, which will be converted into new steel via electric arc furnaces. This change will permanently diminish the demand for imported iron ore as China increases its self-sufficiency in manufacturing steel. Clearly an attractive position for the Chinese government that was happy to block Australian wine, lobsters, cotton and timber but conspicuously not our largest export earner iron ore.

Our Take

We see that investors spend far too much time trying to pick the next Apple or CSL and not enough time thinking about whether there is a Pasminco or AMP lurking in their portfolio. Rather than chasing high return and higher risk investments, Atlas observes that superior performance and lower volatility of returns are best delivered by concentrating on avoiding mistakes or “performance torpedoes”. Looking at the current list of blue chip stocks, we consider that the most probable candidate to become a fallen angel is likely to come from the miners currently riding high on Chinese demand for iron ore.

Fund Update

Disclosing Entity

Continuous Disclosure Notice

Atlas High Income Property Fund

ARSN 618 658 567

25 March 2022

The Atlas High Income Property Fund, ARSN 618 658 567, now has 100 unitholders and is therefore a ‘disclosing entity’ for the purposes of the Corporations Act 2001.

One Managed Investment Funds Limited as the responsible entity of the Fund will follow ASIC’s good practice guidance in satisfying our continuous disclosure obligations using website notices posted to www.oneinvestment.com.au/atlas or

https://atlasfunds.com.au/

Accordingly, given the disclosure of the material information will be made on our website, we will not be required to lodge continuous disclosure notices for this entity with ASIC.

Key Themes from the February 2022 Reporting Season

The February 2022 company reporting period, that concluded this week was more muted than previous periods, coming after the doom and gloom of 2020 and then the recovery and optimism of the August 2021 season. The dominant themes of 2022, moving share prices on the ASX, have not been profitability and dividends, but rather inflation and the invasion of the Ukraine. Frequently over the past month, a great or poor result from a company has been largely ignored in favour of market despair or euphoria.

In this week’s piece, we look at the key themes from reporting season that finished last week, along with the best and worst results and the corporate result of the season.

Better than expected

As a result of the uncertainty from further lockdowns in late 2021 and concerns around inflation in January 2022, general expectations were cautious going into reporting season. The market expected profits to fall sharply from those companies that benefited from CV-19 and a muted outlook from most companies due to an inability to pass through rising input costs. However, February 2022 revealed that 43% of companies reporting beat expectations and only 20% missed guidance and that for the ASX 200 in aggregate earnings per share are expected to rise by 15%! The most significant increases came from energy and financials due to sharp increases in the oil price and solid lending growth in an environment of low bad debts.

Supply Chain Issues/Inflation

After the market sell-off in January on concerns around global supply chains and inflation, in February, questions around cost control dominated the analyst calls with management. The miners all reported strong headline results courtesy of surging commodity prices but are experiencing higher costs. BHP discussed record diesel prices, high ammonia nitrate prices (explosives) and labour shortages in Western Australia impacting production. Similarly, Fortescue reported a 20% increase in their per-unit cost to mine a tonne of iron ore in the December quarter, though with this cost at US$15 per tonne, profit margins remain high.

Retailers Woolworths, Coles and Wesfarmers saw profit margins crimped by rising costs. Woolworths noted that the grocer had seen $150 million in direct COVID-19 costs from daily rapid antigen tests for warehouse and distribution centre staff, as well as increased absenteeism from around 18,000 staff being forced to isolate over the half. Given the moves in oil over the first two months, we expect cost pressures to continue through 2022 based on the cost increases in moving goods through global supply chains.

Conversely, Westpac had a very positive February after delivering $1.6 billion in first-quarter cash earnings; this was ahead of market expectations due to cutting costs and rationalising its operations reducing expenses by close to $1 billion. Woodside saw sharply expanding profit margins in February, benefiting from stable production costs (US$5.30 per barrel of oil) and rising revenues. A feature of offshore LNG plants is the eye-watering upfront construction costs in the billions and a low ongoing marginal cost of production requiring minimal inputs and labour.

Show me the money

The main theme of reporting season was the significant increase in dividends being paid to shareholders. February 2021 saw a record $36 billion in dividends being declared by Australian companies to be paid to investors over March and April. This was a record for the interim dividend period and only marginally below August 2021, which saw $40 billion being paid out. This corporate largess is due to a combination of record iron ore prices (BHP, Fortescue and Rio), lower-than-expected bad debts (Commonwealth Bank) as well as a dramatic recovery in energy prices (Woodside)

Commonwealth Bank’s result is always one of the most closely scrutinised, not only because it is Australia’s second-largest company (losing its mantle as the largest company after BHP collapsed its listing in London), but also due to the nature of its business. With 15 million individual customers and businesses, the health of CBA often mirrors the health of Australia, and the bank provides investors with a very detailed report into the financial health of their customers. We were pleased to see CBA lift its interim dividend from $1.50 to $1.75 per share and almost back to the $2 per share paid pre-CV-19.

In addition to higher dividends, buy-backs were a feature of this reporting season, with CBA, Sonic Healthcare, JB Hi-Fi, Sims Metal and Amcor announcing measures to reduce their share count and boost future earnings per share. Due to the range of off-market buy-backs in 2021 that reduced franking account balances, most of these will be conducted on-market as direct purchases. However, JB Hi-Fi will conduct theirs off-market, where their investors will receive a combination of a tax-efficient capital return and a fully franked dividend which will see excess franking credits transferred from the electrical retailer’s balance sheets into the hands of investors.

Best and Worst

Over the month, the best results were delivered by S32, Northern Star, Challenger, Woodside and Endeavour. Despite the uncertain macroeconomic background and rising cost pressures, these companies reported strong earnings growth ahead of expectations and an optimistic outlook for 2022.

Looking at the negative side of the ledger, we will ignore travel-related companies such as Qantas, Corporate Travel and Flight Centre as their financial results are impacted by government-mandated lockdowns and rising oil prices, rather than poor management decisions. Appen, Dominos Pizza, Mineral Resources, Xero and Reece reported results that were poorly received by the market. The common themes amongst this group are high price to equity (PE) companies that delivered profit results below expectations, combined with forward profit guidance not consistent with high growth companies. Additionally, some Australian tech companies were sold off along with tech companies in the USA, despite meeting guidance.

Our Take

Overall, we were reasonably pleased with the results from this reporting season for the Atlas Concentrated Australian Equity Portfolio. In general, the companies that we own reported improving profits and indeed, for a number of companies in the portfolio, February 2022 saw record profits, dividends and new buy-backs.

February Monthly Newsletter

- February proved to be a very eventful month initially dominated by Australian corporate earnings, which were much better than expected and revealed that corporate Australia is recovering from Covid-19 faster than expected. In the second half of the month, the focus was on the events in the Ukraine rather than corporate earnings

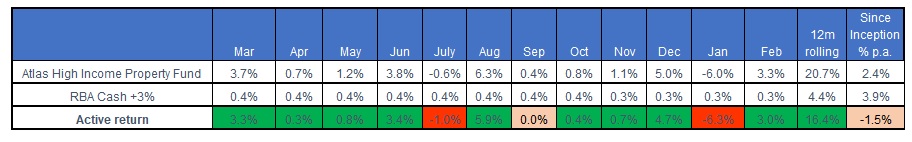

- The Atlas High Income Property Fund had a solid month gaining +3.3% after the companies held in the Fund showed a continued improvement in their financial results. Additionally, management teams guided to higher distributions through the rest of 2022.

- Due to the Fund’s focus on distribution and earnings stability, the February reporting season held few surprises for the companies we own. This is due to rent-collecting trusts offering greater earnings visibility with average lease terms between five and twenty years, whereas trusts with development earnings can be volatile and were sold down.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2022