Two stocks making their way into the ASX 20 (and one on its way out)

We investors are constantly searching for the next CSL. After all, if you invested in this growth darling a decade ago, your cash would have increased by almost 616%. If you had invested two decades ago, that figure would skyrocket to 3097%. But not all stocks that climb their way…

Blog

The top fund manager dividend stock picks for FY23

Sara Allen

Livewire Markets

It’s dividend season and investors might be happily patting themselves on the back for their past decisions – or considering where to put their money so next year’s Christmas in July can afford a turkey as well as the veggies.

What is dividend season you may well ask? August is typically the time that many Australian listed companies announce full-year dividends as part of their end of financial year reports – last year, 81% of ASX200 companies announced a full-year dividend. A record $36 billion in dividends was declared in interim dividends in the February reporting season this year, which investors are hoping will bode well for coming announcements.

With rising inflation and interest rates a theme of 2022, many investors will be more reliant than ever on dividends to support their income needs.

In light of this, I decided to speak to three Australian fund management firms on their top picks for the coming year: Dr Don Hamson and Dr Peter Gardner from Plato, Hugh Dive from Atlas Funds Management and Andrew Hamilton from Antares.

The criteria for sustainable dividends

While it’s tempting to just pick whichever company has offered the biggest pay-out, investors need to take a step back and think about sustainability. Just to be clear, I’m not talking about the environment here but whether a company is likely to consistently be able to a certain level of dividend payments over time.

While some fund managers may look at historical yields as one part of their assessment, investors should be wary of using this as the primary basis for their decision. Just because a company paid large dividends in the past is no guarantee of the future (and sometimes paying unsustainably large dividends might be a sign a company is in trouble and trying to attract investment).

Hugh Dive’s criteria for sustainable dividends includes:

Payout ratios

A ratio higher than 80% is likely to be unsustainable through market cycles. Companies should also be reinvesting some of that profit within the company for future growth.

Gearing

High levels of gearing can be a sign that dividends will need to be cut when markets change. This doesn't apply in the same way to industrials companies. Generally, gearing above 50% is considered high.

Franking credits

If a company is paying franking credits, this can be a sign of earnings quality. An example of this is Onesteel which had issues in their profits and this was reflected by unfranked dividends. This doesn't apply to all companies though. Some like CSL (ASX:CSL) or Amcor (ASX:AMC) have substantial production and revenue streams generated overseas so may not be able to offer significant franking.

"Companies will never pay more tax than they need to so this indicates that the earnings and the dividends are real." Hugh Dive.Dive’s top dividend ideas

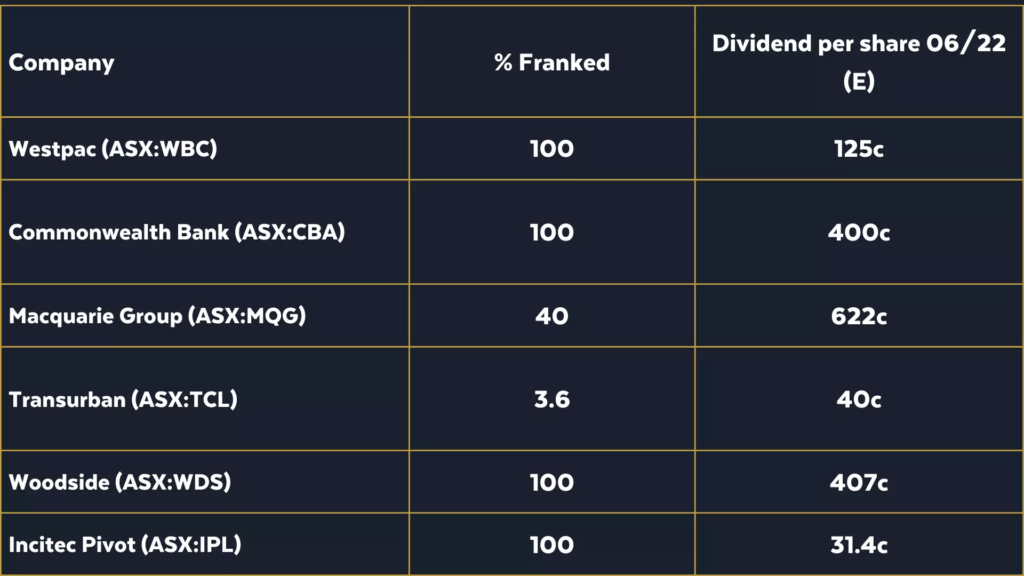

Source: Morningstar as at 10 July 2022. Please note that Macquarie figures are actual rather than expected.

He is positive on the banks and expects them to surprise markets on the upside, including 3 in his recommendations. Dive views the market volatility as being favourable to Macquarie too – a view shared by Hamson and Gardner due to the history of its management team pivoting to a range of market conditions.

Incitec Pivot is an interesting inclusion on his list and is benefiting from the wet weather conditions and food supply shortages.

“The fertiliser market is having a bumper year. There’s a supply shortage, we have sub-soil moisture and farmers will be planting heavily to take advantage so fertiliser will continue to be popular." Hugh DiveIt’s worth noting that Dive views TCL’s payout ratio as higher than what he would normally accept but toll roads have more stable earnings contractually linked to inflation, along with minimal outgoing maintenance capex.

What’s next for investors?

It’s worth noting that the fund managers use these recommendations in the portfolios they manage – but as with all things, that doesn’t mean every stock is suitable for every investor (or every portfolio). It’s a helpful guide though to what characteristics these fund managers are looking for and the methods they use to identify these stocks. If you want more information on these fund managers, please click through to their profiles.

Are these stocks on your list or do you have a hot tip you think has been missed? Let me know your thoughts on top dividend payers for FY23 in the comments below.

June Monthly Newsletter

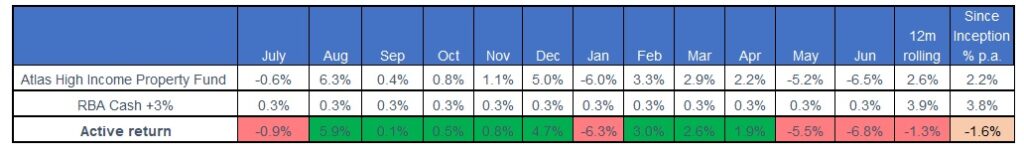

- June proved to be a very volatile month dominated by macroeconomic news predominantly around rising inflation and the prospects of a recession in the USA and Europe, rather than company fundamentals, as companies were in blackout before the August reporting season. The Australian listed property sector was hit hard and declined by -11% over June and -12.3% for the past 12 months.

- The Atlas High Income Property Fund declined by -6.5% in June on general market sentiment rather than investment fundamentals. Atlas is looking forward to the upcoming August profit season, which we expect will show the resilience of earnings for the Trusts we own in the Fund. The first week of July has seen the Fund recover most of June’s decline, with several trusts in the Fund declaring higher than expected distributions.

- The Fund declared a quarterly distribution of $0.032 per unit for the June Quarter. The distribution will be paid to investors in early July, taking the annual yield to 7% for the year ending June 2022.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2023