- February proved to be a very eventful month initially dominated by Australian corporate earnings, which were much better than expected and revealed that corporate Australia is recovering from Covid-19 faster than expected. In the second half of the month, the focus was on the events in the Ukraine rather than corporate earnings

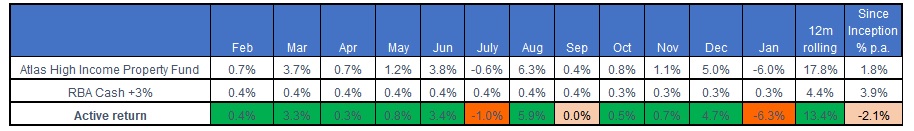

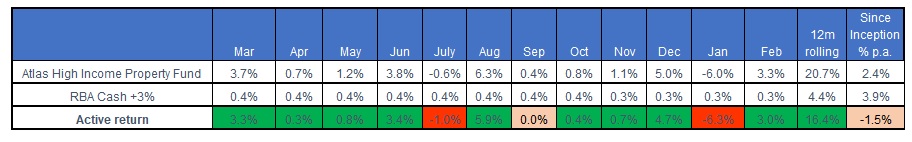

- The Atlas High Income Property Fund had a solid month gaining +3.3% after the companies held in the Fund showed a continued improvement in their financial results. Additionally, management teams guided to higher distributions through the rest of 2022.

- Due to the Fund’s focus on distribution and earnings stability, the February reporting season held few surprises for the companies we own. This is due to rent-collecting trusts offering greater earnings visibility with average lease terms between five and twenty years, whereas trusts with development earnings can be volatile and were sold down.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2022