Is CSL a $300 stock? Fundies unpack its world-class valuation

“When times are good, people don’t sell their blood to CSL,” he said. Indeed, the average 12-month price target is well above today’s price tag at $333, implying CSL is a steal at $307. Sixteen, or 84 per cent, of analysts surveyed by Bloomberg, have a “buy” rating on the company.

Category: Uncategorized

January Monthly Newsletter

- In January, the “Santa Claus” rally came late investors globally shrugged off the concerns that dominated December, namely a recession in the USA and rising inflation. The benchmark 10-year bond rate fell 0.5% to 3.55% based on the

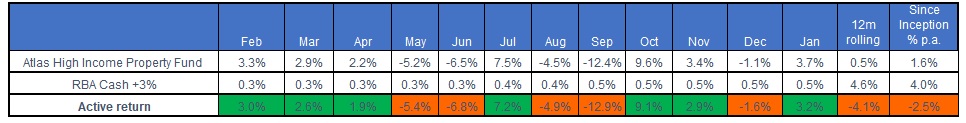

assumption that central bank rate tightening was ending. This saw the more speculative equities and listed property trusts rally in January. However, these same companies saw their share prices fall in early February, with the US Federal Reserve and the RBA raising rates! - The Atlas High Income Property Fund had a solid month gaining +3.7% and erasing December’s falls. Whilst pleasing, share prices in December and January always move with vague macro-economic fears and greed, not actual earnings,

as they trade in a vacuum with company management teams precluded from speaking to the market before releasing their financials in February. - Atlas is looking forward to the February profit season, which we expect will show both the resilience of company earnings from the companies held in the portfolio and that management will guide to higher distributions through the rest of 2023.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2023.

The 5 traps most likely to snare investors

Dogs of the ASX in 2022

December Monthly Newsletter

Investors hoping for a “Santa Claus” rally in December to cap off a dismal year were disappointed, with global indices falling between -4% and -6%. A range of negative forces dominated 2022, namely aggressive interest rate hikes to curb inflation, recession fears, the Russia-Ukraine war and rising concerns over rising CV-19 cases in China. 2022 was the worst-performing calendar year since 2008, with equity markets off between -15% and 19%.

The Atlas High Income Property Fund declined -1.1% in December in a broad-based sell-off for real estate assets that saw the wider Listed Property market fall -4% over the month to cap off a -20.5% decline for the 2022 calendar year.

Over the past year, the share prices of the developers declined the most as investors realised that one-off profits and revaluation gains are likely to evaporate in tougher markets. As such, it is not too smart to value this variable source of income at 30 to 40 times! The Atlas Fund has consistently avoided developers in favour of trusts offering consistent, reliable and forecastable income streams.

The Fund declared a quarterly distribution of $0.031 per unit for the December Quarter, a small increase from September’s distribution. The distribution was paid to investors in early January.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2023