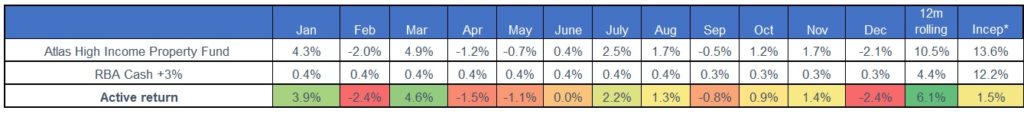

- The Atlas High Income Property Fund declined by 2.1% during December 2019. This was a frustrating result as for most of the month, the Fund was ahead of both the index and in positive territory, but the entire market was sold down by close to -2% in a thinly traded four-hour session on the 31st December. This fall in the unit price has substantially been recovered in early 2020.

- The wider listed property market had a tough month in December falling -4.4%, with the share prices of the property trusts with development earnings being sold down hard. The Fund’s strategy specifically avoids trusts with volatile development earnings in favour of trusts with recurring earnings streams from long-dated leases to high-quality tenants.

- The Fund declared a quarterly distribution of $0.0412 per unit, in-line with the September quarterly distribution. The distribution will be paid to investors in early January.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2020.