- February proved to be a very eventful month, mainly dominated by Australian corporate earnings, which were much better than expected and revealed that many Australian companies are managing higher interest rates and inflationary pressures better than expected.

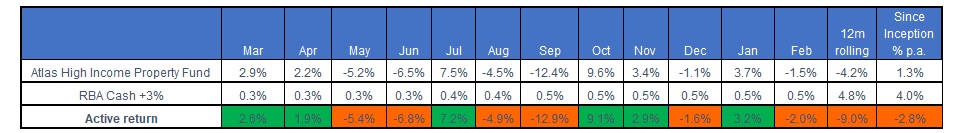

- The Atlas High Income Property Fund fell by -1.5%, mirroring the wider property sector. Overall, it was frustrating not to February showed companies we own to be in good health, mainly owing assets with high-quality tenants that offer non-discretionary goods and services, whose demand is likely to remain consistent in a slowing economic environment.

- It was pleasing to see the companies held in the Fund increase their dividends on average by +12% in the February reporting season, with every company in the Fund paying a dividend. Atlas sees that rising dividends are a better measure than earnings per share of a company’s actual health. While in the short term, the market is a voting machine, rewarding popular companies, in the long term, it is a weighing machine and recognises companies that consistently pay dividends to shareholders and increase income at levels above inflation.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2023.