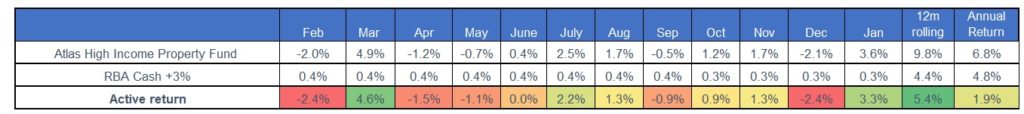

- The Atlas High Income Property Fund gained by 3.6% during January. While this was an above-average return, a portion of these gains was a recovery after some curious price activity on the last day of 2019. Here the entire market was sold down by close to -2% in a thinly traded four-hour session. In hindsight, this appears to have been an offshore index fund reducing its weight to Australian securities, with these losses recovered in the first week of January.

- The key news over the month was a large fall in the Commonwealth Government 10-year bond yield that fell to 1%, as the negative impacts of both bushfires and the Coronavirus on the Australian economy have raised the probability of further rates cuts by the RBA.

- The falling official cash rate has seen the major banks cut their benchmark 180-day term deposit rates fall to 1.25%. While this looks grim for savers, the situation is likely to get worse with six-month interest rate futures at 0.65% which points towards further cuts.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2020.