- July saw global equities rebound on a view that central bank tightening of interest rates is ending, as the inflation rate increases in developed markets and Australia start to slow, and retail sales soften. In July, the RBA kept the cash rate at 4.1%, a stance that was continued at their meeting in early August.

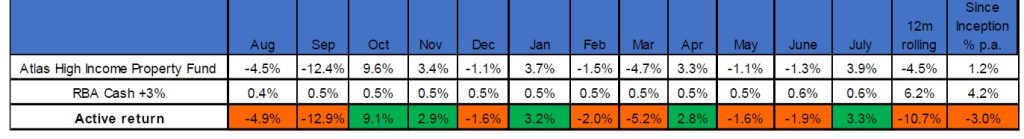

- The Atlas High Income Property Fund gained +3.9%, recovering from falls in May and June on minimal company-specific news. Pleasingly every stock in the portfolio was in positive territory over the month.

- Atlas is looking forward to the upcoming August profit season, which we expect will show a continued improvement in the financials of the companies we own, and that management will guide to higher distributions through the rest of 2023. We were pleased with the distributions declared in late June by many of the companies held by the Fund, which augurs for few surprises on results day. A benefit of owning companies with steady earnings backed by recurring contracted cash flows is that management can declare dividends right at the end of the June and December financial periods.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2023.