- May proved to be a very volatile month dominated by macroeconomic news predominantly around rising global inflation, EU bans on Russian oil and mobility restrictions in China. Domestically the RBA increased 0.25% to 0.35%, the first increase in the official rate since November 2010. This increase saw the property sector fall by -9% over the month, with most of the pain being felt by the high price to earnings property developers, which the Fund avoids.

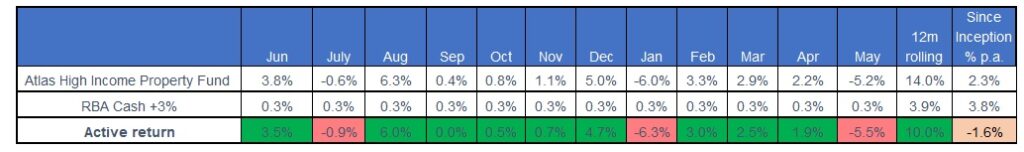

- The Atlas High Income Property Fund declined by -5.2% in May on general negative market sentiment rather than investment fundamentals. Atlas is looking forward to the upcoming August profit season, which will allow management teams to demonstrate how their earnings increase with inflation. With the bulk of the companies owned by Fund declaring distributions in late June, this expected earnings resilience will be revealed in the next two weeks.

- As the Fund is populated with Trusts that deliver stable earnings today, revenue that increases in line with inflation and debt hedged for an average of 5 years, rising inflation should have a limited impact on the Portfolio. Indeed some Trusts will benefit from inflation over the short to medium term, as profits rise faster than interest costs.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2022