- October was a weak month, with global markets retreating between -1% and -3% due to concerns about the US election, with commodities volatile on opaque indications of what the purported Chinese stimulus plan may look like. Over the month, the Chinese central bank lowered interest rates again to boost consumption but stopped short of any stimulus that would increase the need to consume more iron ore.

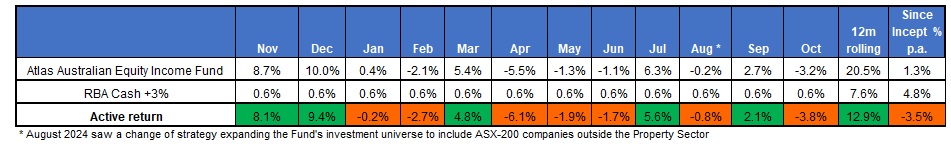

- The Atlas Australian Equity Income Fund declined by 3.2%, mainly due to macroeconomic fears rather than the outlook for individual company profits in 2025.

- Looking back at October 2023, there were many reasons to sell equities, with both the US and Australia touted to head into recession and further rate rise tipped to occur in 2024 to combat inflation. However, this would have been a mistake as the past twelve months have been very positive for investors in Australian equities, who have enjoyed returns of over 20%. Indeed, against a grim backdrop, one year ago, many individual companies reported strong trading conditions, at odds with the doom and gloom prevailing in global share markets.

Go to Monthly Newsletters for a more detailed discussion of the market and the fund’s strategy going into 2025.