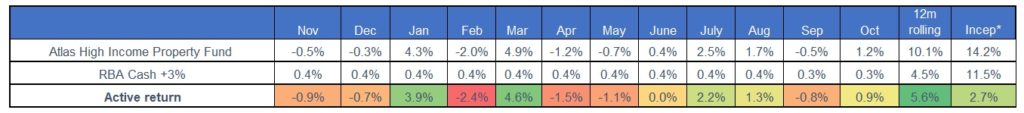

- The Atlas High Income Property Fund had a solid month in October gaining +1.2%. While global markets mostly posted a positive return, the ASX 200 declined, dragged down by the heavyweight banking and the mining sectors.

- The key news over the month was the RBA cutting the cash rate by 0.25% to a new record low of 0.75%, we see that it is likely that there will be further cuts over the next year in response to higher unemployment. Currently, twelve-month deposit rates are at 1.6%, so to earn a mere $20 in interest per day a retiree needs to have over $500,000 on term deposit!

- The Fund remains populated with trusts that offer investors recurring earnings streams from rental income rather than development profits. Due to fixed price rental increases, the distributions that the Fund is receiving from our investments are growing ahead of inflation.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2020.