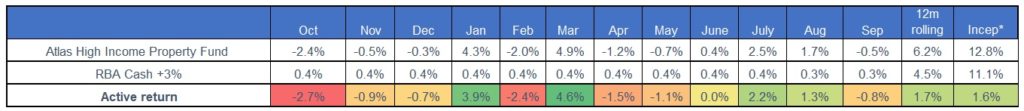

- The Atlas High Income Property Fund declined by 0.5% during September, avoiding much of the carnage that saw the wider Listed Property sector fall close to 3%, as the share prices of those trusts with development earnings were sold off aggressively due to concerns that the property cycle has peaked for these trusts.

- The benchmark Australian 10-year government bond yield rallied to 1% in September, though this strength in the bond yield has was reversed in early October with the RBA cutting rates to +0.75%. Rising bond rates were attributed to the news that Australia posted its first current account surplus (courtesy of rising iron ore prices) since the Whitlam government in June 1975!

- The Fund declared a quarterly distribution of $0.042 per unit, a slight increase over the June quarterly distribution. The distribution will be paid to investors in early October

- Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2020.