The greatest returns on the stock market rarely come from buying the well-loved stocks whose share prices have performed strongly, but rather from unloved companies that outperform low expectations.

As a fund manager I like to sift through the market’s trash to find some investment treasure.

A systematic investment strategy of investing in underperforming companies, named “Dogs of the Dow”, was popularised by Michael O’Higgins in his 1991 book Beating the Dow. This approach seeks to invest in the same manner as deep value and contrarian investors do.

O’Higgins advocates buying the ten worst-performing stocks over the past 12 months from the Dow Jones Industrial Average at the beginning of the year, but restricting the stocks selected to those that are still paying a dividend.

Limiting the investment universe to a large capitalisation index like the Dow or ASX 100 improves the chance that the unloved company has the financial strength and understanding capital providers (existing shareholders and banks) to support a recovery over time.

Smaller companies tend to face a harder road to recovery, with a greater chance of insolvency when they make it onto the “Dogs” list.

The strategy then holds these ten stocks over the calendar year and sells them. The process then restarts.

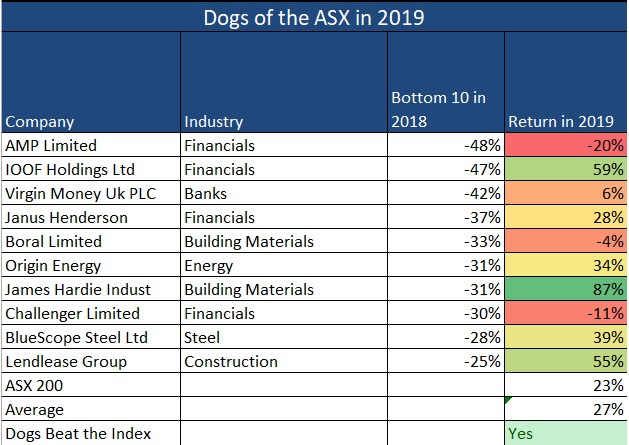

While buying the worst-performing companies each year involves owning some with issues that may worsen, this strategy has outperformed the Dow in seven of the past ten years, and the ASX in six of the past ten years with a tie in 2018.

One of the reasons why this persists is that institutional investors report the contents of their portfolios to asset consultants for annual review. This process incentivises fund managers to sell their “Dogs” towards the end of the year, a process known as window dressing the portfolio before being evaluated.

IOOF, for example, lost 52 per cent in 2018. In early 2019, fund managers with IOOF in their portfolios would have been facing some pretty stern questioning about why they owned the troubled wealth group. IOOF’s share price recovered by 54 per cent throughout 2019 to be one of the top-performing stocks on the ASX last year.

Here, retail investors can wield an advantage over institutional investors, picking up companies whose share prices are under pressure late in the year ahead of any possible rebound when the selling pressure stops in January and February. Retail investors can afford to take a longer-term view.

The better strategy

Over the past year, the “Dogs” from 2018 returned 27 per cent, significantly outperforming the ASX 200 index’s return of 23 per cent. Underperformance from AMP, Challenger and Boral was outweighed by recoveries in the share prices of James Hardie, Lendlease, IOOF and BlueScope Steel.

The common theme in the reversal of performance of 2018’s “Dogs” is an improvement in the company-specific issue that had been weighing on the share price. James Hardie benefited from both a recovery in the US housing market and falling raw material costs; IOOF rebounded as it stabilised the ship; and Lendlease progressed its troubled engineering business towards a sale, demonstrating the underlying strength of its global residential developments.

When we went through this exercise in January 2019 looking at which of the “Dogs” would shine, Atlas saw that the pain would likely continue for both AMP and IOOF, a view that was only partially correct.

Atlas considered that the share prices of Janus Henderson, Lendlease and Virgin Money UK (the former CYBG) were the most likely to rebound over 2019, as these businesses either solved issues or recovered on the prospect of a workable path to Brexit, with investments made in Lendlease and Janus Henderson.

Looking at the ASX 100 underperformers for 2019, the key themes impacting their market valuations are falling coal prices, interest rates, and a slowing domestic housing market.

In seeking to identify which among these “Dogs” will shine in 2020, history suggests that it will be those companies whose falling share price were due to company-specific problems, rather than industry-wide issues such as a falling commodity price.

We see that construction company CIMIC and financial services group Link Administration are the most likely to stage a recovery, either due to a takeover bid in the case of CIMIC, or a Brexit-led recovery in Link’s financial administration business.

This piece originally appeared in the Australian Financial Review