Short Sellers were caught on the wrong side of the market when Domino’s Pizza (DMP) and JB Hi-fi (JBH) surprised the market with results better than expectations. Hugh Dive from Atlas Funds Management explores the top shorts going into reporting season and how they have performed in August 2019. Dive says “Going into reporting season, as a fund manager, it is always good to look at where other investors are positioned – and in particular those that have a different view to you”. In this interview Dive explains how short selling works, the four steps to shorting and how the “favoured” July shorts have performed in the August and the dramatic impacts of a Short Squeeze on share prices. Domino’s Pizza delivered a result that was around market expectations, with sales in Japan and Europe offsetting weakness in Australia. DMP’s share price has rallied since the result after management gave a positive outlook for 2020, telling the market that sales were up close to 5% over the first 7 trading weeks of the new financial year. The short thesis for DMP was that further deterioration in Australia would cause this high PE stock (PE 25x) to de-rate further. Looking at JBH, when you are short a stock the last thing you would want to see is the company delivering net profits above their guidance, which is what JBH did last week. Overall this was a very solid result from this world-class electrical retailer in a challenging consumer backdrop. 2020 may look better due to a range factors such as declining mortgage rates, tax cuts and a higher credit growth (and household formation from APRA lending changes.

Author: Hugh Dive

AFR: ‘The more robust companies will survive’

CNBC: Not surprising that BHP is conservative on the outlook

Unpacking AMP’s results for FY19

AMP’s first-half results were released last Thursday morning – what

But is it a buy or are you just catching a

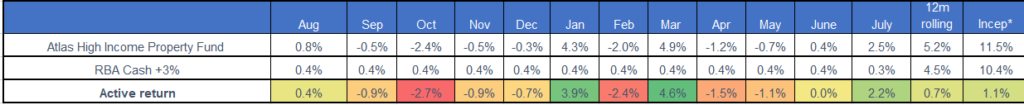

July Monthly Newsletter Atlas High Income Property Fund

- The Atlas High Income Property Fund gained by +2.5% over the month of July in a quiet month that had limited news flow with

the majority of listed companies in “blackout” prior to the release of their half-yearly results in August. - The key news over the month was the RBA cutting the cash rate by 0.25% to a record low of 1%. The falling official cash rate has seen the major banks cut their benchmark 180-day term deposit rates fall to 1.4%. While this looks grim for savers, the situation is likely to get worse with six-month interest rate futures at 0.78% which points towards further cuts.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2020.