Buy Hold Sell: 6 stocks that could surprise in 2024

As we round out another year of Buy Hold Sell, we’re taking the chains off. Normally, we try to keep things civil by putting a handful of stocks to our guests and asking for their analysis. Whilst guests don’t always agree, at least they don’t have to analyse each other’s highest conviction picks.

Author: Hugh Dive

Livewire: The dogs and darlings of the ASX in 2023 (and what to back in 2024)

CNBC: Woodside investor explains why he is against a potential Santos merger

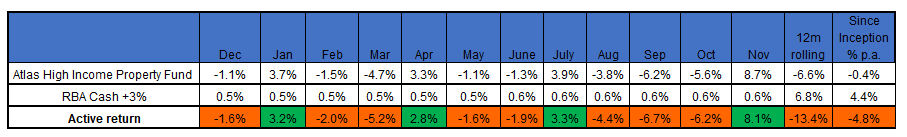

November Monthly Newsletter

- November saw a recovery from October’s lows as equity markets rallied after the US Federal Reserve hinted that they were at the peak of this interest rate cycle. Domestically, while the RBA raised the cash rate by 0.25% at the start of November, weaker the expected inflation and retail sales data released towards the month’s end suggested tightening monetary policy was finally working.

- The Atlas High Income Property Fund gained by 8.7%, with the share prices of many companies in the Fund recovered from the falls seen during the market panic in September and October. The falls in September and October were based on the assumption that property and infrastructure trusts would see falling profit margins, unable to raise prices yet faced with rising interest rate costs as shorter-term debt was refinanced. While some companies structured their debt this way before the GFC, few are in this precarious position in 2023.

- The Fund is populated with Trusts that deliver stable earnings today, revenue that increases in line with inflation and debt hedged for an average of 5 years. As such, inflation and rising debt costs will have less impact on profits than markets fear. In December, many companies held in the Fund will declare dividends, which are expected to show the resilience of company earnings.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2024.