Korea’s Kospi tumbles 3%; Asia-Pacific markets drop as negative sentiment remains

Shares in the Asia-Pacific fell on Monday as negative sentiment continues to weigh in on markets.

Blog

August Monthly Newsletter

- August saw most Australian companies release their financial reports for the first six months of 2022. The month showed that Australian listed companies are in better health than feared, with more companies beating expectations and guidance than missing.

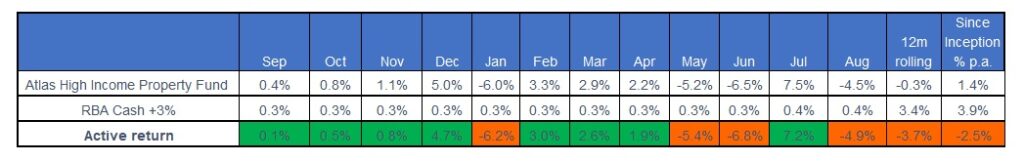

- The Atlas High Income Property Fund fell by -4.5%, mirroring the wider property sector, despite having a good reporting season based on rising profits and dividends from the companies held in the Fund.

- It was pleasing to see the companies held in the Fund increase their dividends on average by +13% in the August reporting season, with every company in the Fund paying a dividend. We see that dividends are a better measure than earnings per share of a company’s actual health. While in the short term, the market is a voting machine, rewarding popular companies, in the long term, it is a weighing machine and recognises companies that consistently pay dividends to shareholders and increase income at levels above inflation.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2023

Key Themes from the August 2022 Reporting Season

The August 2022 company reporting period concluded last week. In aggregate, this earnings season was far better than feared going into August, with the market expecting falling profit margins from higher inflation, interest, and labour costs. August showed that Australian listed companies are in better health than feared, with more companies beating expectations and guidance than missing. The ASX 200 gained +1.2% in August, an excellent outcome, with Europe and the USA down between -4% and -5%.

In this week’s piece, we look at the key themes from reporting season that finished this week, along with the best and worst results and the corporate result of the season.

Better than expected

As a result of the uncertainty from spiking inflation, supply chain issues and rising labour costs in 2022, general expectations were cautious going into reporting season. June saw a heavy sell-off in global equities, with most markets falling between -5% and -9% due to rising inflation and the prospects of a recession in the USA and Europe. Despite a recovery in July, the prevailing view was that Australian corporates would deliver weaker profits from falling revenue and higher costs due to an inability to pass through inflation.

However, August results from Australian companies saw 40% of companies beat analyst estimates, showing that they were too pessimistic about the ability of management teams to pull levers to maintain profit margins. An example of this can be seen in CBA‘s results that saw expenses fall by -1.5%, and a key component of this is likely to be the reduction of their expensive branch network. Towards the end of CBA’s voluminous 136-page Investor Discussion pack, the bank revealed that since 2020 they had reduced their branch network from 1,134 to 807. Culling underutilised branches have lowered the bank’s annual property costs and reflect banks’ changing business model and how they deliver financial services. In 2022 CBA saw one million in-person branch visits over twelve months compared with nine million online transactions processed daily!

Supply Chain Issues/Inflation

In 2022 we have seen two major market falls on the ASX due to concerns around inflation, one in January (-6.4%) and again in June (-8.8%), and in August, questions around cost control dominated the analyst calls with management. The miners all reported strong headline results courtesy of surging commodity prices but are experiencing higher costs. BHP discussed record diesel prices, high ammonia nitrate prices (explosives), and labour shortages and pointed to higher costs in 2023. Similarly, higher costs were an issue for Woolworths both in their supermarkets and Big W, with the company reporting that they had incurred $323 million in Covid costs mainly relating to cleaning, labour and supply chain issues.

However, inflation did not impact all companies uniformly in the August reporting season. Packaging company Amcor increased profits and maintained margins after successfully passing on US$1.5 billion in extra costs to customers from increases in resin, plastic films and aluminium prices. Inflation is not much of an issue for toll road owner Transurban. With the bulk of the company’s tolls automatically increasing with inflation with a few strokes of a keyboard and the company’s debt primarily fixed for the next seven years, rising inflation results in higher profits over the short to medium term.

Woodside saw sharply expanding profit margins in August, with profits up 414%, benefiting from stable production costs (US$7.20 per barrel of oil) and rising revenues. A feature of offshore LNG plants is the eye-watering upfront construction costs in the billions but a low ongoing marginal cost of production requiring minimal inputs and labour.

Show me the money

Another theme of reporting season was better than expected dividends being paid to shareholders, though August 2022 was down on the previous year, which saw a record $40 billion being paid out to shareholders. The major miners (BHP, RIO and Fortescue) all cut their dividends significantly by between 10 and 50% due to a combination of falling commodity prices, uncertain outlook, higher future capex and upcoming takeovers.

Unlike the last two reporting seasons, shareholders were not showered with new share buybacks, with only Nine Entertainment, A2 Milk, Spark New Zealand and Qantas announcing significant buybacks. Qantas’ buyback deserves a special mention, announcing a $400 million buyback despite reporting a $1.86 billion loss, easily the most unusual buyback I have seen in my career analysing stocks. While investors liked the buyback and Qantas’ share price increased by +15%, in our opinion, this looks to be a courageous decision with the airline facing an uncertain outlook, having wracked up $7 billion in losses over the past few years and received $2 billion in financial support from the government.

What lies ahead?

When economies are going through transition periods like what we are currently experiencing, moving from near-zero interest rates and no inflation to rising interest rates, the financial statements from a reporting season can provide a misleading picture of future company profits and dividends. The August 2022 reporting season detailed company profits for the first six months of 2022. While unemployment has remained very low, since June 30th 2022, home loan mortgage rates have increased by 2%, the inflation rate has increased from 3.7% to 6.1%, and key commodity iron ore has fallen 21%. If these moves are sustained, the next 12 months will be less profitable for many companies on the ASX than the past year.

Best and Worst

Over the month, the best results were delivered by Whitehaven Coal, A2 Milk, Woodside, Ampol, S32 and WiseTech. Despite the uncertain macroeconomic background and rising cost pressures, these companies reported strong earnings growth ahead of expectations and an optimistic outlook for 2023.

Looking at the negative side of the ledger, Bendigo Bank, Reliance, ASX, Dominos Pizza and F&P Health fell over the month after reporting earnings below market expectations. The common theme among the first three in this list is companies having difficulties passing through rising costs to consumers. Covid-19 beneficiaries Dominos Pizza and F&P Health fell after reporting that sales were normalising quicker than expected and that profits would fall in 2023.

Result of the Season

The most impressive result from the August reporting season came from Woodside Energy which reported a net profit after tax of US$1.8 billion, up +414%, reflecting a recovery in the oil price and the sale of spot LNG cargos into North Asia in 2022 at substantial premiums to contracted prices. The company’s dividend increased by +263%, gearing a mere 9%. Around a year ago, Woodside faced difficulties in selling stakes in their growth projects and questions about whether the company could fund these projects. Now thanks to the combination of high energy prices and cash-generative BHP Petroleum assets acquired in 2022, Woodside can fund these internally.

Our Take

Overall, we were reasonably pleased with the results from this reporting season for the tlas Core Australian Equity Portfolio. In general, the companies that we own reported improving profits and indeed, for several companies in the portfolio, August 2022 saw record profits and dividends.

As long-term investors focused on delivering income to investors, we look closely at the dividends paid by the companies we own and, in particular, whether they are growing. After every reporting season, Atlas looks to “weigh” the dividends that our investors will receive from company profits. While share prices move every second between the hours of 10 am and 4 pm, dictated by changing market emotions, ultimately, the sole reason for buying a share is to access a share of that company’s profits paid in the form of dividends.

Our view is that talk and guidance from management are often cheap. Also, company CFOs can use accounting tricks to manipulate earnings reported on the Profit and Loss Statement, but actually paying out higher dividends is a far better indicator that a business is performing well and that directors are not concerned about the future.

Using a weighted average across the portfolio, our investors’ dividends will be +39% greater than the previous period in 2021 (or +24% excluding Woodside). Every company held was profitable and paid a dividend. This result compares very favourably with the broader ASX 200, which saw average dividends fall by -8% in August 2022. On this key measure, we are pleased with the results of the August 2022 reporting season.

July Monthly Newsletter

- July saw a recovery in equity markets driven by a better-than-expected US company earning season and a contraction in bond yields globally. In Australia, bond yields fell by -0.6% to 3.06% in July, with the market now pricing in rate cuts in 2023. This is an example of “bad economic news = good news for equities”, with the market viewing that increased recessionary risks with limit future interest rate rises.

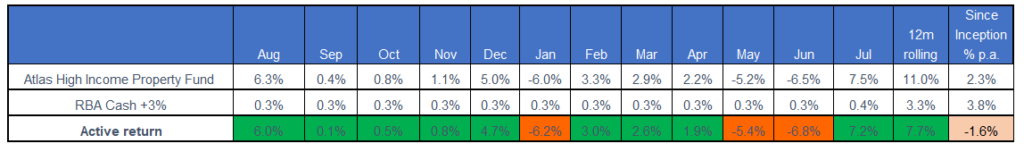

- The Atlas High Income Property Fund gained +7.5%, recovering the falls in June on minimal company-specific news. With companies in blackout before releasing their six-monthly results in August, share prices are moved by macroeconomic concerns rather than company fundamentals.

- Atlas is looking forward to the upcoming August profit season, which we expect will show a continued improvement in the financials of the companies we own, and that management will guide to higher distributions through the rest of 2023. We were pleased with the distribution guidance provided in late June by many of the companies held by the Fund.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2023