- July saw a recovery in equity markets driven by a better-than-expected US company earning season and a contraction in bond yields globally. In Australia, bond yields fell by -0.6% to 3.06% in July, with the market now pricing in rate cuts in 2023. This is an example of “bad economic news = good news for equities”, with the market viewing that increased recessionary risks with limit future interest rate rises.

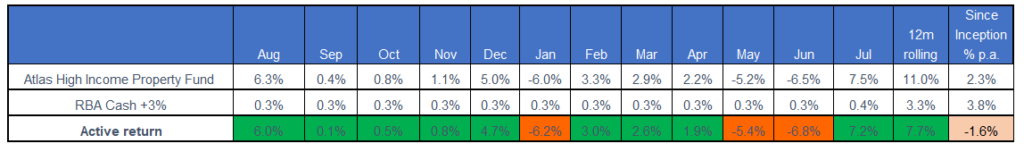

- The Atlas High Income Property Fund gained +7.5%, recovering the falls in June on minimal company-specific news. With companies in blackout before releasing their six-monthly results in August, share prices are moved by macroeconomic concerns rather than company fundamentals.

- Atlas is looking forward to the upcoming August profit season, which we expect will show a continued improvement in the financials of the companies we own, and that management will guide to higher distributions through the rest of 2023. We were pleased with the distribution guidance provided in late June by many of the companies held by the Fund.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2023