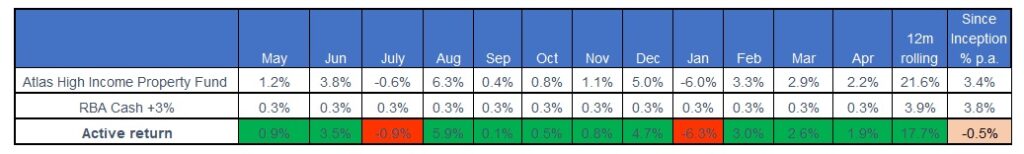

- The Atlas High Income Property Fund had another solid month gaining +2.2% avoiding market falls both in Australia and globally. April was a very volatile month, with the S&P falling -9%, MSCI World -7% and the ASX 200 -1%. Rising inflation, the expectation of central bank rate hikes and the ongoing war in the Ukraine saw investors globally become more risk-averse.

- Concerns about inflation continued to influence markets over April, which was negative for companies with minimal to no earnings today, but with the promise of large profits in the distant future. As the Fund is populated with Trusts that deliver stable earnings today, revenue that increases in line with inflation and debt that is hedged for an average of 5 years, rising inflation should have a limited impact on the Portfolio.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2022