Mr Burns: Let’s have a look at my stock portfolio. Hmm. Confederated Slave Holdings. How’s that doing? Smithers, why didn’t you tell me about this market crash?

This calls for an aggressive trading strategy. Take 50% of my money and put it in the blue chips – Transatlantic Zeppelin, Amalgamated Spats… Congreve’s inflammable Powders, U.S. Hay… and sink the rest into that up-and-coming Baltimore opera hat company. That should set things right again, eh, boys?

Simpsons S08, Ep21 The Old Man and the Lisa

This week a colleague raised with me the investment strategy of buying a basket of well-known blue chip stocks and then consistently reinvesting any excess cash to buy more of those same shares. Blue Chip stocks are the large well-established household names, in the top 50 companies listed on the ASX, with a market value in the tens of billions. Stockbrokers recommend these companies to their clients based on the perception that they are safe and stable and following the axiom “Nobody ever got fired for choosing IBM”. They are viewed safe for advisors to recommend even if they fall in value.

However, like Mr Burns found out in this Simpsons episode, market conditions for once financially sound companies like Transatlantic Zeppelin and US Hay are not always permanent. The Hindenburg disaster of 1937 and the development of passenger airplanes eradicated the demand for slow moving flammable airships and penetration of motor cars permanently diminished the demand for horses as a form of transport and thus the demand for hay.

The leading companies of today will not necessarily look like the top companies in ten years’ time. Indeed, some of the top blue-chip companies from 2022 will almost certainly either see their value fall to a fraction of their current price or slide into administration in the coming years.

What is a blue-chip stock?

The term “Blue Chip Stock” was first used by Oliver Gingold of Dow Jones in 1923 and referred to high priced stocks. “Blue” was a poker reference, as in poker sets the highest value chip is traditionally the blue one. Since then, the term has come to denote high quality stocks, with consistent revenue growth and dominant market positions in their industry. These companies typically have a stable debt to equity/interest coverage ratio and generate superior return on equity (ROE). Over time this translates into a high market capitalisation that places a company in the Top 50 companies listed on the ASX. Currently the smallest stock (Lend Lease) in the ASX Top 50 has a market value of over A$7 billion.

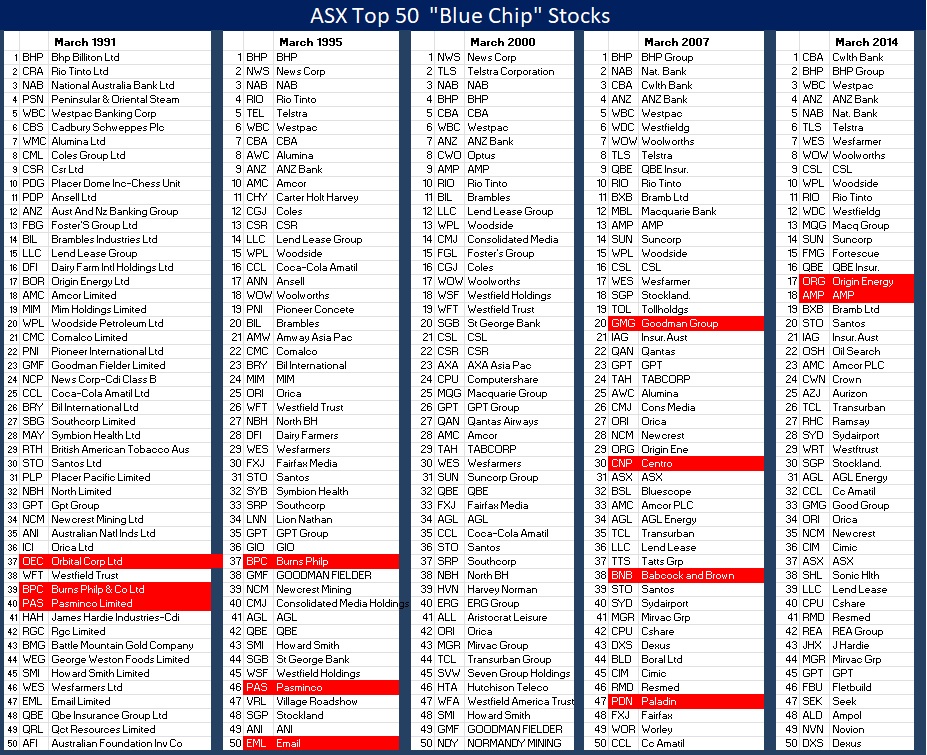

The below table looks at the Top 50 stocks on the ASX by market valuation at five points in time over the last 30 years. There are many familiar names such as BHP and Westpac that were considered blue chips in 1991 and retain that status today, but there are also many that would be unfamiliar to many investors today. Whilst most of these (Cadbury Schweppes, North Broken Hill, PNO, Dairy Farm Holdings) have disappeared from the share market due to being taken over by other companies, in each period there are a number of so called blue chips that either ultimately went into administration (Centro/Paladin/Babcock), faced catastrophic losses very soon after appearing (Goodman) or faded away to a small fraction of their previous size (AMP/Orbital Engine). The faded blue chips in the table are coloured in red.

Too much debt

In early 2007 shopping centre trust Centro Properties was riding high after making a string of acquisitions in Australia and the USA. It was viewed as highly innovative, dubbed the Macquarie Bank of Property Trusts due to its use of debt to create a global property empire. After acquiring a portfolio of 469 small shopping centres across 38 US states for A$3.9 billion, the trust was managing A$26 billion of property. As a result of the acquisition, Centro Properties upgraded its forecast 2008 financial year distribution growth to 19%. However instead of rising distributions, in December 2007 Centro Properties faced significant problems in refinancing US$5.5 billion of debt that was due in a very challenging market. Additionally, the shopping centre owner faced questions about the accuracy of their financial accounts after billions of dollars in short-term bridging debt was classified as long-term debt. As a result of asset write offs, Centro Properties in June 2009 reported a negative net tangible assets (NTA) of -$2.23 per share (it was trading at $0.16 per share at the time, down from a high of $2). Ultimately equity holders were essentially wiped out as the mountainous debt burden was converted into equity.

Origin Energy ended 2014 with a very high debt level due to the construction of a LNG export facility in Queensland which the company had difficulty paying back after energy prices fell heavily. While still a large company, Origin has been a poor investment since March 2014 underperforming the ASX200 by 112% due to a dilutive capital raise to pay down debt and dividends being suspended for several years.

Financial Engineering

In 1998 zinc miner Pasminco was one of the premier global zinc miners after buying the Century project from Rio Tinto. The company developed an audacious hedging strategy to lower debt costs by borrowing in USD and hedged the currency based on the expectation that the AUD would remain between US68c and US65c. Unfortunately, the AUD/USD fell to below 51c in 2001 at the same time that the zinc price crashed. This left the company with limited cash flow and losses on the hedge book that blew out to $850 million when the company went into administration in late 2001.

The combination of too much debt and financial engineering

No discussion of faded blue chips would be complete without looking at investment bank Babcock & Brown. At its peak in June 2007, the investment bank was lauded as a creative user of financial structuring and a fee-generating machine that propelled the company’s share price to $34.63, with a market capitalisation above $9 billion. From meetings that I had with Babcock & Brown management prior to the GFC, they also made no secret of the fact that only a small amount of their earnings could be characterised as “recurring” and that most of the profit (used to pay dividends) was generated by revaluing assets cannily acquired by the company.

Similarly, to Centro, Babcock & Brown both entered the GFC with too much debt and – more importantly – too much short-term debt that needed to be refinanced in a challenging market. In June 2007, the Babcock & Brown group had amassed $80 billion in assets, supported by $77 billion in debt, much of this held off balance sheet or characterised as “non-recourse” and held by satellite funds. The company collapsed in 2009 after a falling share price triggered debt covenants and the company was unable to refinance the debt due. Ultimately, in very complex liquidation proceedings the noteholders ended up receiving 2c in the dollar for bonds held and equity holders received nothing.

Technology that did not work as expected

The orbital engine was invented by Ralph Sarich in 1972 and at one time was expected to revolutionise combustion engines, with fewer moving parts and greater efficiency. In 1991, the future for Orbital – a company that owned the technology for orbital engines – looked bright and BHP took a 25% stake in the company. Despite this promise, a range of technical problems with cooling and lubricating the engine proved unsolvable and both the founder and BHP ran for the exits. Orbital still exists selling fuel injection technology and propulsion systems for drones, but with a share price of $0.29, which is a long way from its peak at $24.

ERG’s future looked bright 17 years ago and it was a glamour tech stock listed on the ASX offering smartcards for mass transit systems from Moscow to Manila. Whilst the technology itself was sound the company was effectively sunk, not by the offshore moves but by difficulties in implementing the ERG’s T-Card in Sydney and issues with the NSW State Government which led to the project being scrapped. Ultimately this resulted in lawsuits and the company was delisted in 2009.

Not recognising changing market conditions

For most of this century AMP was considered a blue-chip stock and arguably the premium and most trusted insurance and investment (or superannuation) brand in Australia, founded in 1849 and listed on the ASX in 1998. AMP’s vertical integration (the AMP branded adviser selling an AMP product to a client) model arguably made the company lazy, as it insulated AMP from external market competition. The 2018 Hayne Royal Commission exposed the flaws in this model and has seen advice, investment administration and investment management being unbundled. Since March 2014 AMP’s share price has fallen from $5 per share to 94c and the market capitalisation has dwindled from $16 billion to $3 billion.

What the Future Holds

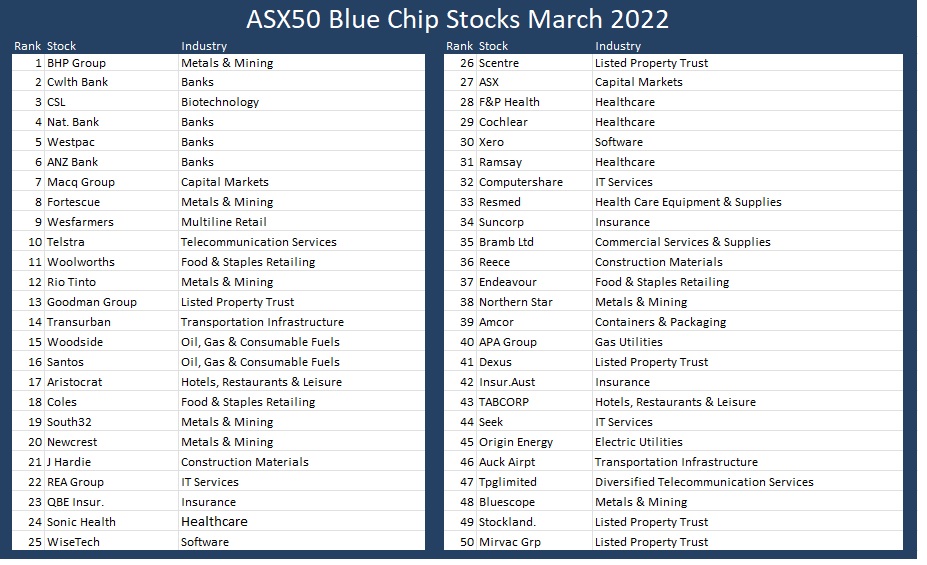

The above table shows the ASX Top 50 as of March 2022, ranked by market capitalisation. Whilst it is usually hard to identify at the time which leading companies will falter in the future, history strongly suggests that amongst this list there are one or two, currently considered blue chips that will either go into administration or slide back into insignificance. Below we identify some considerations that might influence the future fates of current blue chips:

High leverage

In March 2014 Fortescue looked like a candidate for a blue chip that might blow up, with 70% gearing resulting from $10.5 billion in net debt and the company looking to sell off infrastructure assets. However, a period of sustained high iron ore prices since 2019 has allowed the company to pay off $6 billion in debt and reduce gearing to a more manageable 23% in 2022.

Amongst the blue-chip stocks in the table above, the companies with the highest debt burden as measured by gearing (net debt divided by total equity) are APA Group (242%), Transurban (121%) and Ramsay Healthcare (75%). The key characteristic of these heavily geared companies is the view that the stable returns from airports, pipelines, toll roads and hospital procedures affords the ability to service high levels of debt.

Whilst these companies own wonderful assets and point to both the spread of debt maturities and their interest rate hedges (which lock in a portion of the company’s debt at a fixed rate), these hedges will expire and debt currently attracting low rates will almost certainly have to be refinanced at higher rates.

Technology does not work as expected

Whilst we do not consider this likely and believe that the company has instituted many safeguards, blood therapy company CSL does face the risk of product recalls through contamination. In 2008, CSL’s rival Baxter faced a product recall after 81 deaths were linked to tainted blood thinning drugs produced under contract in China, but sold in the US under Baxter’s name. Similarly medical device manufacturers Cochlear and Resmed face issues from Chinese competitors that consistently look to copy the intellectual property in their hearing and sleep apnoea devices.

Left Field

Miners BHP, Rio Tinto and Fortescue have all benefited greatly from a twenty-year construction boom in China, selling iron ore and coking coal to feed an army of blast furnaces, with most to all company profits coming from iron ore. In 2000 China produced 120 million tonnes of steel and imported around 100 million tonnes of iron ore. In 2021 imports of iron ore had grown to 1.1 billion tonnes of which 70% came from Australia.

Steel is primarily produced using one of two methods, either via a blast furnace or an electric arc furnace. Blast furnaces use iron ore, coking coal and limestone to produce iron, all of which are dug out of the ground in Australia and shipped to China. Electric arc furnaces produce steel by melting scrap steel with electricity. As an economy matures it starts creating a pool of scrap steel as the rebar in buildings and steel in cars is recycled. In 2021 only 15% of Chinese steel was produced using recycled scrap, whereas in the USA over 70% of steel is produced using scrap metal.

While there will still be demand for Australian iron ore, China will certainly start generating increasingly larger amounts of scrap steel, which will be converted into new steel via electric arc furnaces. This change will permanently diminish the demand for imported iron ore as China increases its self-sufficiency in manufacturing steel. Clearly an attractive position for the Chinese government that was happy to block Australian wine, lobsters, cotton and timber but conspicuously not our largest export earner iron ore.

Our Take

We see that investors spend far too much time trying to pick the next Apple or CSL and not enough time thinking about whether there is a Pasminco or AMP lurking in their portfolio. Rather than chasing high return and higher risk investments, Atlas observes that superior performance and lower volatility of returns are best delivered by concentrating on avoiding mistakes or “performance torpedoes”. Looking at the current list of blue chip stocks, we consider that the most probable candidate to become a fallen angel is likely to come from the miners currently riding high on Chinese demand for iron ore.