- December saw investors holding out for a “Santa Claus” rally rewarded with continued strength from November across the world indices in December. The key factor driving solid returns in share markets was the view that rate cuts are likely in 2024. The year ended with a recession in either the US or Australia that many predicted twelve months ago, with economies more resilient than expected and better placed to weather higher interest rates.

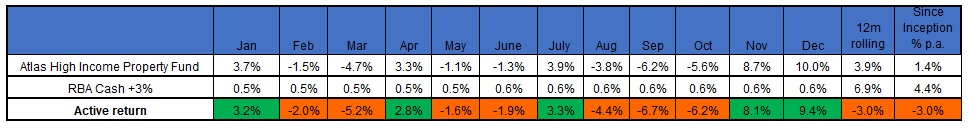

- The Atlas High Income Property Fund gained by 10% in December, following a continued recovery in November as investors started believing that interest rates peaked in Australia and the US. December saw most of the Fund’s holdings

declare distributions, all in line with expectations and higher than those paid in the second half of 2022. This contributed to the rally in share prices, offsetting the doom and gloom from August to September. - The Fund declared a quarterly dividend of $0.03 per unit for the December Quarter, a small increase from the September distribution. The distribution will be paid to investors in early January.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2024.