The last 12 months have been very kind to investors in Australian equities, with the ASX 200 index returning 24%, as the market recovered the sharp falls from March 2020. While the ASX 200’s return is market-weighted, a better measure of the broad-based gains of Australian shares can be seen in the median1 return of 25.7% of the ASX 200. Against this background of strong equity market performance, many investors will be looking at the stocks that have performed poorly over the past 12 months, looking to sell some of their winners and find the hidden gem or two that will rebound sharply in 2022.

In this week’s piece, we will look at the “dogs” of the ASX in 2021, see how 2020 Dogs performed and review how accurate Atlas’s predictions were in July 2020.

Dogs of the Dow

Michael O’Higgins popularised a systematic investment strategy of investing in underperforming companies named “Dogs of the Dow” in his 1991 book Beating the Dow. This approach seeks to invest in the same manner as do deep value and contrarian investors. O’Higgins advocated buying the ten worst-performing stocks over the past 12 months from the Dow Jones Industrial Average (DJIA) at the beginning of the year but restricting the stocks selected to those still paying a dividend. Restricting the investment universe to a large capitalisation index like the DJIA or ASX 100 improves the unloved company’s chance of recovery. Larger companies are more likely to may have the financial strength or understanding capital providers (such as existing shareholders and banks) that can provide additional capital to allow the company to recover over time. The thought process behind requiring a company to pay a dividend is that its business model is unlikely to be permanently broken if it is still paying a distribution. A company’s directors are unlikely to authorise a dividend if insolvency is imminent. The strategy then holds these ten stocks over the calendar year and sells them at the end of December. The process then restarts, buying the ten worst performers from the year that has just finished.

Retail investors have an advantage

One of the reasons this strategy persists is that institutional fund managers often report their portfolios’ contents to asset consultants as part of their annual reviews. This process incentivises fund managers to sell the “dogs” in their portfolio towards the end of the year as part of “window dressing” their portfolio before being evaluated. For example, in July 2020, fund managers with Virgin UK in their portfolios would have seen some pretty stern questioning from asset consultants about why they owned the UK bank facing the worst economic conditions in the UK since the 1970s, rising bad debts and uncertainties around Brexit. However, Virgin UK’s share price recovered by +122% throughout the year to be one of the top-performing stocks on the ASX.

Here retail investors can have an advantage over institutional investors, picking up companies whose share prices have been under pressure from the tax loss selling around the end of the financial year. Furthermore, retail investors can afford to take a longer-term view on the investment merits of any particular company that may have hit a speed bump.

Dogs of the ASX in 2020

Over the past year, the Dogs from 2020 returned 32.5%, significantly outperforming the ASX 200 index’s return of 27.8% in what was an extraordinary year. From the table below, six out of the ten “dogs” of 2020 outperformed the ASX 200, with Virgin UK, Worley Parsons and NIB Holdings leading the charge. Virgin UK exceeded meagre market expectations on significantly lower bad debt charges and an improving outlook. Similarly, engineering contractor Worley Parsons had the benefit of low market expectations and a recovery in the oil price that saw the company continue to win contracts. NIB saw the benefit of customers paying for private health cover and a fall in costly elective procedures. CIMIC’s woes continued in 2021, drifting lower on delays in infrastructure contracts being awarded due to further lockdowns.

Our picks from July 2020

When making our picks twelve months ago, Atlas noted that the task was much more challenging than in previous years. The principal reason for the falls over FY 2020 was not company-specific issues that are in management’s power to fix, but rather due to an external shock from Covid-19.

Atlas correctly picked that NIB would surprise in 2021, as CV-19 restrictions reduce the number of elective private hospital procedures and healthcare premiums are paid upfront. Less successful were our picks that CIMIC would benefit from increased infrastructure spending flowing on from stimulus plans. Equally, we were cautious towards big winner Virgin UK based on the view that with international travel off the table, the trajectory of bad debts incurred by a British bank would be difficult for investors in Australia to forecast accurately.

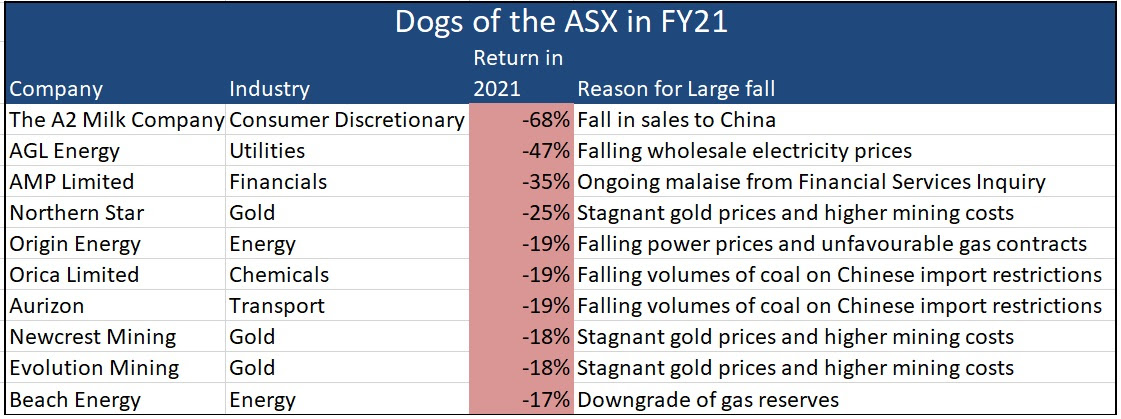

What does the class of 2021 look like?

Looking through the list of the underperformers of 2021, the key theme again is that the falls are from factors that are outside the company’s control, such as Chinese import restrictions on Australian goods, falling electricity prices or the gold price.

China’s President Xi Jinping’s bellicose speech in Tiananmen Square over the weekend at the centenary of the Chinese Communist Party gave little indication that investors can expect China to relax import restrictions on Australian goods in the near term. Similarly, it is difficult to see a significant increase in wholesale power prices for AGL Energy and Origin Energy in the face of government policies designed to drive down prices.

Our Picks for 2022

In selecting a significant share price recovery candidate in the following year, we generally look at companies whose woes are company-specific, and AMP certainly fits the bill. However, the embattled financial services company faces the difficult task of rebuilding a damaged brand, legal actions by sections of its adviser base and declining funds under management as rival managers successfully prise investment mandates away from AMP. AMP is likely to see further pressure on profit margins in 2022, as revenue falls much faster than its ability to trim its cost base.

Consequently, Atlas are picking Beach Energy and Newcrest among the gold miners to outperform in 2022. In 2021 Beach’s share price was under pressure after the company mandates cut production guidance and downgraded its Western Flank Field reserves. The share price fall seems excessive given that this field comprises only 5% of Beach Energy’s reserves, and the company is benefiting from a sustained recovery in energy prices. Newcrest and the other gold companies have faced a weaker gold price due to outflows from Gold ETFs in the early part of 2021. Atlas see that this is likely to reverse in 2020, and Newcrest will outperform the other gold companies on this list due to its low-cost operations, growth potential and conservative balance sheet.

This piece was first published in Livewire Markets

1.The median return of an index can give a better indication of a general return for a group of stocks as unlike a mean it is not skewed by extremely high and low returns, nor in the case of market cap weighted returns such as the ASX200 by the performance of the largest companies.