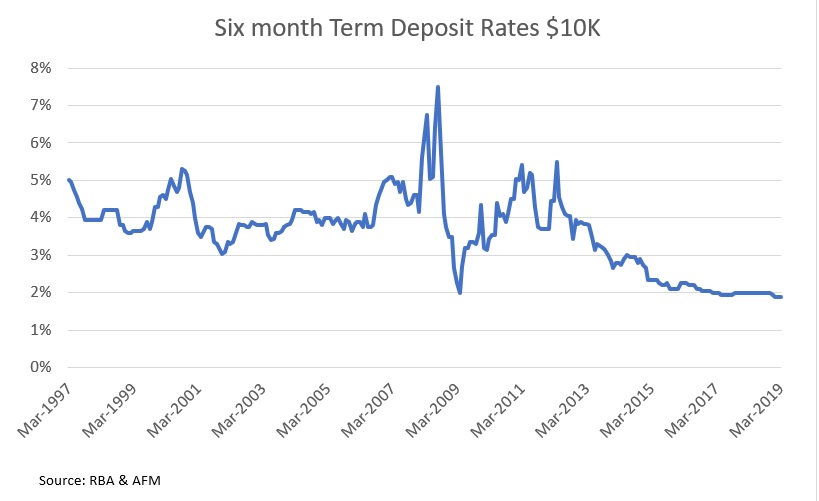

In 2019 we have seen the Australian 10-year bond rate fall from 2.75% to 1.75%, a significant move given that in April 2018, the market was expecting that interest rates would be rising throughout 2019 and 2020. While this sounds a bit esoteric, falling bond rates depresses term deposit rates. At the moment the market expects that the RBA will cut the cash rate later on in the year (currently at 1.5%), possibly at their meeting on Melbourne Cup Day in November.

Further cuts to the interest rate will only intensify the hunt for yield among investors, especially those in pension phase looking to live off the income delivered by their investments. As term deposits roll off and investors are faced with pretty meagre reinvestment options, we would expect investors to rotate investments out of cash and into other yield assets such as shares and listed property trusts. In this week’s

Financial Repression

Financial repression is a term used to describe measures used by governments to boost taxation income, economic activity and demand for government debt. These measures include attempts to hold down interest rates to below inflation and represent a tax on savers, conferring a benefit on borrowers. The positive impact of these measures is that it becomes cheaper to borrow money to invest possibly boosting economic growth, however this effectively becomes subsidised by the nation’s savers.

Over the last

While the 2% rate on one-year term deposits in Australia looks grim (especially in light of inflation running at 2%), spare a thought for investors in other major Western nations. Retirees in the USA are currently being offered 0.03% from Bank of America, in Germany a touch higher at 0.05% with HSBC in the UK offering 0.55% all for the same six-month term deposit. Near zero rates in Europe, Japan and the US (and historically low rates in Australia) are positive for middle-aged borrowers, asset owners and corporates refinancing debt at lower rates; but represent a significant negative cost for savers.

Stable and Growing Distributions

When we look at dividend-paying stocks and high-yielding listed property trusts we are not overly concerned with the trailing or next period payment, but rather in understanding whether a company can maintain their distribution over the long term and importantly grow it ahead of inflation. Indeed, picking a basket of stocks or trusts solely based on their historical dividend yield has been a path to under-performance. When looking through the list of the highest yielding securities in the ASX200, a common factor is usually a high payout ratio (dividend per share divided by earnings per share).

Payout Ratios too high

Companies with a high payout ratio generally possess fewer options to grow a distribution or maintain it over a variety of market conditions. High payout ratios are often attributed to companies that are either mature or in operate in low-growth industries with few investment opportunities to grow their business, or management looking to maintain the dividend in an environment where the company’s earnings are deteriorating and thus prop up the share price. In some situations, these companies are even borrowing to pay their dividend may be retaining insufficient cash to maintain their assets. This was the case with Telstra for several years, until they bit the bullet and cut their dividend from 28 cents per share to 22 cents per share in 2018.

Looking at other well-owned high yielding stocks on the ASX, it is tough to see NAB maintaining their dividend in the future. In 2018, NAB paid a dividend of $1.98 on cash earnings of $2.02 per share, given NAB has just taken on a new CEO and need to build their capital position by retaining earnings, we would be very surprised if the bank does not cut their dividend later on in 2019.

Maintaining asset quality for property trusts

When assessing the quality and sustainability of the distribution of a property trust you have to look at the percentage of the distribution covered by earnings less the costs of maintaining the quality of the trust’s assets such as replacing lifts, escalators and indeed incentive payments necessary to retain tenants. Before the GFC a large number of property trusts were paying out virtually all of the rental income they collected and were not retaining sufficient funds to cover maintain the quality of their assets. Trusts with higher distributions saw their share prices re-rated higher. In the short term these capital improvements were covered by borrowing money and issuing new equity, but eventually these high distributions proved to be unsustainable and were cut.

Franked dividends = tax payments

Franked dividends have a tax credit attached to them which represents the amount of tax the company has already paid on behalf of their shareholders for the profit they have earned in any given year. While companies can make a range of aggressive accounting choices that can boost their earnings per share (and dividend per share), a company is extremely unlikely to maximise the tax that they pay to the government.

Firms that pay franked dividends have significantly more persistent earnings than firms that pay unfranked dividends, as it indicates that a company is building up tax credits by generating taxable earnings in Australia.

A great example of the role that franking plays in indicating the sustainability of a dividend occurred in 2014 where steel company Arrium paid unfranked dividends in 2013 and 2014. Despite paying dividends and reassuring the market as to the company’s future, Arrium conducted a massive capital raising in late 2014 to shore up a shaky balance sheet and ultimately went into administration in 2016 with debts of $4 billion. Here the lack of franking could be viewed as an indicator that the quality and sustainability of the company’s dividends was not high. However, this measure is not useful for companies such as CSL and Amcor who generate large proportions of their profits outside Australia are unable to pay fully franked earnings.

Our View

When constructing a portfolio designed to deliver income above the meagre returns being offered by term deposits, Atlas see that it is not enough simply to pick high yielding securities. In selecting yield stocks investors should make a detailed assessment of the ability of a company to continue paying and growing distributions ahead of inflation.

Demographic change will see more investors are moving from the accumulation to the retirement phase, which will increase demand for equity fund managers to deliver income to investors. This could be very interesting as in the fund’s management world, the vast majority of the focus is on growing capital by buying stocks that the fund manager believes will rise dramatically. This growth approach typically results in swings in the value of portfolios and minimal dividends. Alternatively an “income approach” to investing involves thinking about how an investor’s capital can be deployed to deliver ongoing income necessary to fund a comfortable retirement.