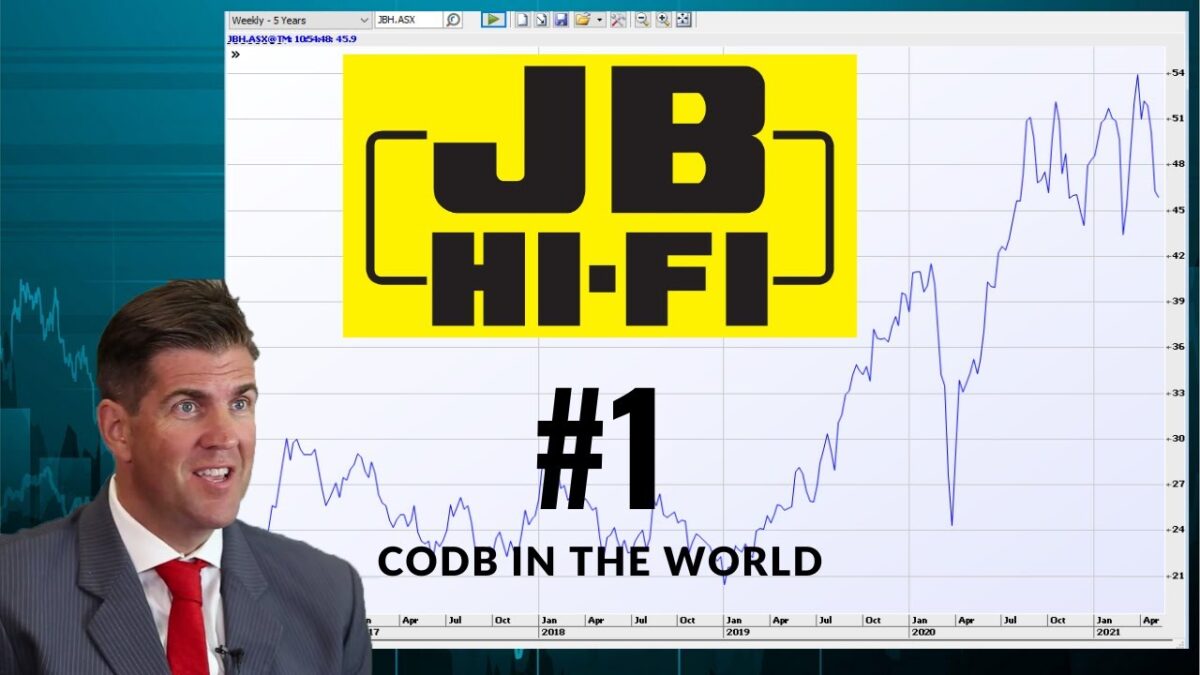

In all of these cases the nay-sayers have been proved wrong with JBH returning +150% over the past 5 years (vs ASX 200 +35%) and the stock being a graveyard for short-sellers Earlier this week JBH was again in the news releasing a very solid trading update for Q1 2021 (Q1 2021 sales up 11.5%), but also announcing that their CEO had jumped ship to clothing retailer Premier Investments.

Hugh Dive from Atlas Funds Management walks us through the finances and quality metrics of JB Hi Fi to understand how they’re a world leader in the cost of doing business, despite the relatively high Australian wages on the global scale.