We look at the question of dividend sustainability very closely when constructing the Atlas Core Australian Equity Portfolio. One of the main factors in building the portfolio is identifying companies that can deliver consistent distributions that are growing ahead of inflation, whilst actively avoiding companies with distribution risk. Aside from wanting a consistent yield for our investors, as we have seen with Telstra over the past few years, high current distributions do not compensate investors for the capital fall that occurs when the dividend is cut. Indeed we often see that a small dividend cut has an over-sized impact on the company’s share price.

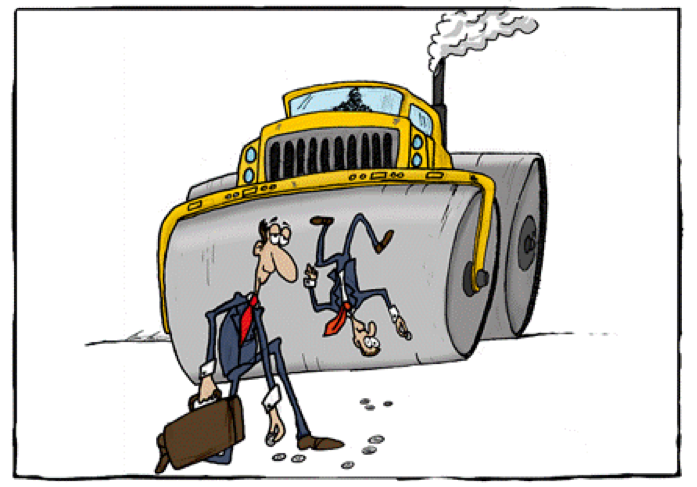

In investing terms, buying companies that have a chance of cutting their dividend this is a bit like picking up pennies in front of a moving steamroller, you may snatch a few coins but eventually your arm will get crushed by the roller! In this week’s piece we are going to look at dividend sustainability.

Key indicators for dividend sustainability

The dividend payout ratio divides the dividend by the earnings per share and this is something that we look at closely to gauge if a company can both maintain and grow its dividends. When a company paying out 90 to 100% of its earnings faces a small change in profitability, it will have to cut its dividend, whereas a company with a payout ratio of say 50% not only can handle the inevitable changes in market conditions, but also has the scope to increase dividends without an increase in company profits. With some companies such as Transurban, for accounting reasons, you will want to use free cash flow instead of earnings, which are impacted by accounting items such as a high depreciation charge. Over a number of years up until 2018 Telstra maintained a dividend around 30 cents per share, however this was achieved via paying out all of its earnings in dividends and indeed in some years the company was borrowing to pay the dividend. A position that was clearly unsustainable in the long term.

Leverage is another factor that we look at when evaluating whether a company can sustain and grow their dividend. Here we are looking both at standard ratios such as debt to equity and interest coverage; as well as when the debt is due. Whilst leverage magnifies returns to equity (and thus dividends) when times are good, when conditions deteriorate and the heavily indebted company’s bankers come hammering at the door, cutting the dividend is inevitably their first action. For example, in 2015 rising debt levels forced grocery wholesaler Metcash to cancel the dividend for a number of years in an effort to reduce gearing.

Finally, we look at earnings and cash flow growth, as if a company is not growing earnings it is obviously not in a position to increase dividends and this may be the sign that the company operates in a stagnant or declining industry. Ultimately investors buy shares in a company in the anticipation of receiving a stream of earnings that will grow ahead of inflation. If dividends are static, then their real value (i.e. value after deducting inflation) declines annually. One of the reasons why we like toll road company Transurban is because the revenue they receive from road tolls automatically grows each year which feeds into rising dividends. For example, the tolls on the M2 motorway in Sydney increase quarterly by the greater of quarterly CPI or 1%; in effect a 4% annual increase.

Amcor ticks many of the boxes

Amcor is a company that we own in the Australian Equity portfolio offering a solid 4.6% yield that ticks all of these boxes. Amcor has a dividend payout ratio is 70% with an extensive history of providing growing dividends. The company has an interest cover of 7.5 times and net debt divided by earning of 2.9 times, which indicates that the company does not face any imminent balance sheet stress.

Continued growth in in flexibles packaging in the US and Europe as well as the developing markets for this market leader will allow Amcor to continue to grow the dividend for shareholders. Additionally, further weakness in the AUD will boost profits for Australian investors, as the packaging company generates all of its earnings outside Australia.

What about Telstra and its 8% yield?

Whilst we are looking at Telstra as at some stage it may represent good value, it still looks too early despite the company currently offering a 8% fully franked yield. Telstra 2022 will be a complicated process with high execution risk and Telstra as a company has a poor long-term record of executing on complex projects. Historically companies have struggled to successfully make significant changes to their business without slipping up whilst their core offering is under pressure. Additionally, Telstra attracts a higher degree of political scrutiny than most firms face which may hamper their ability to reduce their headcount by the planned 8,000 staff members.

In 2018, Telstra is expected to pay a dividend of 22 cents per share but falling earnings from increased competition and restructuring charges may necessitate further cuts in 2019. Additionally, from 2020, NBN payments which are being used to support the dividend begin to taper off. Given this environment, we see that there are other companies that will offer safer and more stable returns for investors seeking income from Australian equities

Our Take

Despite our focus on delivering high fully franked distributions we have avoided some high dividend payers such as Telstra, as our investment process focuses on dividend sustainability and precludes investing in companies that may pay a high current dividend, but have a probability that this will be reduced in the medium term. One of the lessons that that we consistently observe is that when a company cuts its dividend (often for the right reasons) their share price frequently gets punished excessively by vengeful yield investors. Here the several years of high dividends is normally outweighed by the heavy decline in the dividend-cutting company’s share price.