The last six weeks have seen some wild fluctuations in the share prices of many US tech stocks, which appear to have impacted the ASX’s tech sector. In August Apple (+22%), Facebook (+14%), Tesla (+74%), and ASX AfterPay (+33%) had strong months with share price gains significantly higher than the index. However, September has seen these high-flying companies come back to earth, falling between 10-20% over the past 15 days.

One reason why markets rise sharply is that when are more buyers than sellers. However, sometimes it is difficult (as it was in August) to determine a reason why individual stocks post strong gains, especially when a company has not provided new news.

Last month we saw the financial press clutch at straws trying to find the reason behind steep price movements that were markedly different from both the underlying index and the overall market. However, in the last week, it has been revealed that a large options trade from Japan’s Softbank, in combination with retail trader exuberance, seems to have prompted outsized gains in these prominent tech names. In this week’s piece, we are going to look at how relatively small trades in derivatives can have a large impact on underlying share prices.

Setting the Scene

2020 has seen a dramatic increase in the numbers of retail investors entering equity markets for the first time, typically opening brokerage accounts with the zero-cost platforms such as Robinhood in the USA and Commsec in Australia. Many of these new investors are stuck at home with stimulus payments, no sports to bet on, and uncertain economic prospects, so have gravitated towards investing in shares. Naturally, many of these often millennial investors have invested in tech stocks with which they are familiar. These stocks also have the appeal of delivering earnings growth in an uncertain environment. Therefore we have seen tech stocks globally gain sharply in 2020, trading on valuation measures that defy conventional logic. An example is the loss-making APT, trading on 44x revenue.

Institutional investors have also been forced to buy these growth companies. As these stocks become a larger part of the index they must be included in index funds. Active managers concerned about underperformance – and often ignoring valuations – buy them for fear of missing out.

Magnifying gains through options

Facing uncertain economic prospects and observing that the FAANG (Facebook, Apple, Amazon, Netflix and Google) stocks only seem to go upwards, an increasingly large number of investors have sought to magnify their gains by investing in call options rather than physical shares. Additionally, with companies such as Tesla sitting at a share price of US$2,200 (pre-stock split) and Amazon at US$3,100, buying call options for a fraction of the cost is seen as a cheaper way to participate in the rally.

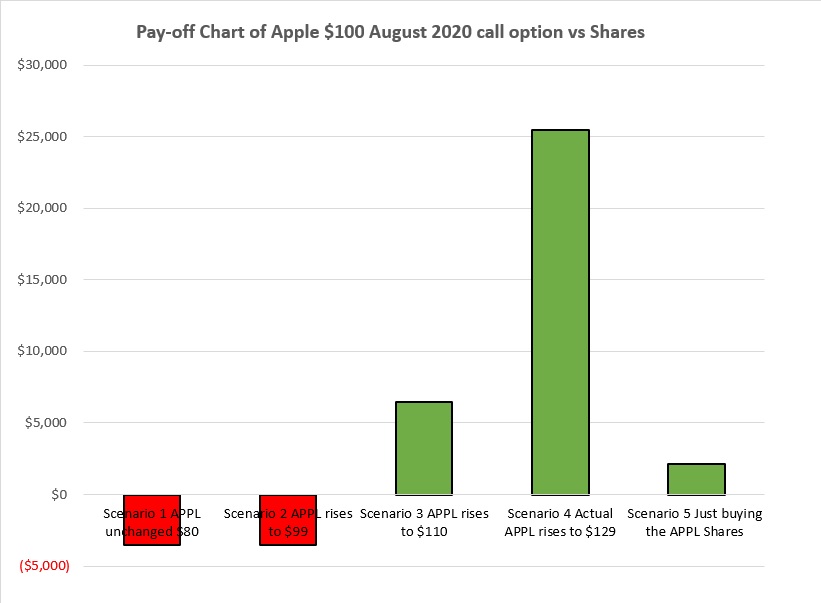

Call options are financial derivatives that give their holders the right to buy a specific asset by a particular time at a given price. For example, in early June Apple (AAPL) was trading at $80 per share; a three-month call option for/with August expiry with a $100 strike price was trading at $3.50 for one contract for 100 shares. So, for an initial outlay of only $3,500 – which buys 10 Apple call options – the investor has exposure to the movement for the next three months of $80,000 worth of Apple shares. If AAPL finishes August below $99, the investor loses the $3,500 premium paid in May; if, however, the price increases to $110, the investor makes a profit of $6,500 (after subtracting the price initially paid for the call premium).

As APPL finished August at $129 per share, the actual profit was much higher at $25,000, a significant gain for an initial outlay of $3,500.

From the above table, you can see that buying “out of the money” call options (options that have a settlement price far higher than the underlying stock’s current share price) in late May generated a substantially larger profit than the $2,144 that would have been gained from simply buying the AAPL shares at $80 and selling at $129 in late August. Though if AAPL had increased from $80 to $99, the holder of the $100 call option would have lost the $3,500 paid for option in early June.

Higher returns attract new entrants

Purchases of call options surged going into August in the USA. Small day traders spent around US$40 billion on call premiums according to data from the Options Clearing Corp. The options buying was concentrated in the popular tech sector names such as Apple, Facebook, Amazon, Netflix, Alphabet, and Microsoft. Most of these companies had a record amount of call options outstanding in August, and upward momentum in their underlying share prices generally.

Into this heated market, Japan’s Softbank reportedly paid $4 billion to buy short-dated out of the money call options with a notional value of $30 billion, with the counterparty’s major investment banks. This very large options position likely exacerbated the tech rally in August and then fuelled the fall in September as it was unwound.

Delta Hedging

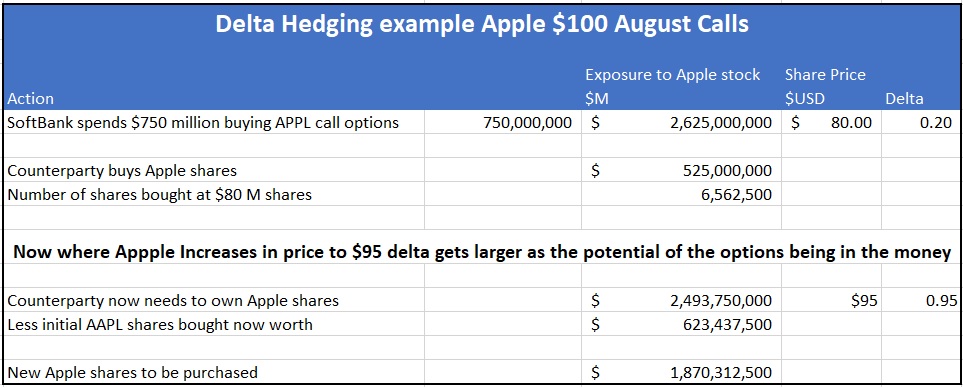

In an options trade, Softbank’s counterparty would buy a certain amount of stock to hedge their potential losses based on the sold call option’s delta. This is done to prevent significant losses in the event that the option finishes in the money and the counterparty has to deliver the stock to the option holder.

An option’s delta expresses the change in price a derivative is likely to see based on the price of the underlying company’s share price. The delta varies according to the distance between the current share price and the price at which the option can be exercised, as well as the time left in the option contract.

Take the above example of Apple $100 August call options. In late May with Apple’s share price trading at $80, the delta on these options was 0.2. SoftBank’s assumed purchase of AAPL options (along with the outstanding retail) for $750 million would have resulted in the counterparty selling Softbank the call options initially buying $525 million of AAPL stock to hedge their exposure.

However, as AAPL gained sharply through July and in particular in August, in our example SoftBank’s counterparty would have been forced to buy more AAPL stock in the market to delta hedge their exposure. As the delta of the options approached 0.95, in this example the counterparty bank would have needed to purchase around $1.8 billion in AAPL stock, putting upward pressure on the share price. On average the value of AAPL shares traded per day is around $1billion, and this increased to above $3 billion in August. It is likely that the “melt-up” of AAPLs share price was due to the forced buying of AAPL stock by investment banks looking to hedge their exposures to the derivatives contracts sold both the the NASDAQ Whale and the legions of retail investors.

Our take

Share price movements typically reflect the balance between the number of buyers versus sellers of stock on a particular day. However often the reasons behind price movements can be quite opaque. The August gains in tech stocks in the USA which probably had an influence on the ASX’s tech stocks such as AfterPay were likely influenced by the forced buying of tech names such as AAPL, due to the delta hedging activities of the investment banks that sold call options. Similarly, the falls in September are likely to be due to these positions being unwound. For example, Softbank almost certainly did not want to take delivery of $38 billion worth of AAPL stock in late August, preferring a cash settlement from the banks that sold them the options.

From these observations, one could take the view that buying out of the money call options is a sound investment strategy. However, around 80% of call options expire worthless with the seller collecting the premium. As a regular seller of call options in the Atlas High Income Property Fund, this has been our experience over many years. We find that buyers are generally too optimistic with regard to the expected near-term share price gains. Indeed, all of the options that we sold at the end of June, for expiry last Thursday on the 17th September, expired out of the money. This earned Atlas extra income that helps us pay our 7% yield.