- May saw a continuation of the recovery in the property market as the number of new cases of CV-19 in Australia has slowed and the government announced plans to reopen Australia by July. The Australian share market received a boost after the government announced in late May that due to reporting errors, the expected cost of the JobKeeper wage subsidy program is expected to cost $60 billion less than previously estimated.

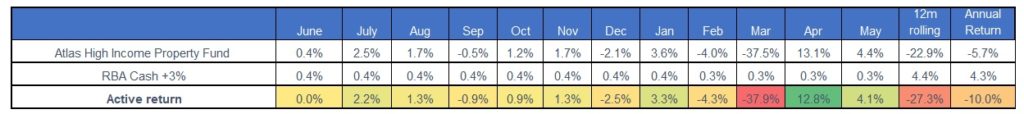

- The Atlas High Income Property Fund gained +4.4% over the month. Pleasingly several holdings in the portfolio not only gave trading updates showing that their businesses have been less impacted by CV-19 than initially feared, but also confirmed their upcoming June distributions.

- While the property sector faces challenges in 2020 due to a weakening economy, not all assets face the same challenges as discretionary retail; with office, industrial and infrastructure tenants mostly keeping up with their rental obligations. June is likely to be a critical month for listed property, as the opening up of the economy will give landlords greater certainty as to their earnings profile over the next year.