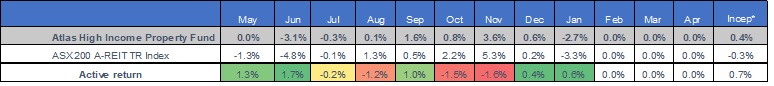

- January was a weak month as the listed property sector was sold off -3.3%, due to rising bond yields weighing down on income stocks globally.

- The Atlas Fund returned -2.7% in a month where there were few places for investors to hide, as all trusts were sold down with little regard to the quality of their property assets, nor their earnings outlook.

- The Fund remains positioned towards Trusts that offer recurring earnings streams from rental income rather than development profits. As the Fund’s distributions are supported by long-term lease agreements with blue-chip industrial companies, and not swinging emotions of the market, we see that the Fund will be well placed to weather current market volatility.

Go to Monthly Newsletters for a more detailed discussion of the listed property market in January and the fund’s strategy going into 2018.

Go to Monthly Newsletters for a more detailed discussion of the listed property market in January and the fund’s strategy going into 2018.

Skip to content