- September was a very weak month, with global markets falling between -6% and -11% on fears of a global recession and continued tightening by central banks. Global listed property markets were off between -7% and -19% in September, with Australian Listed Property down -14%. Concerns around rising interest rates reducing profitability for property and infrastructure assets were the dominant theme. However, this assumes both the inability of company profits to rise with inflation and that company debt is short-term duration with a variable interest rate. While some companies structured their debt in this fashion before the GFC, few are in this precarious position in 2022!

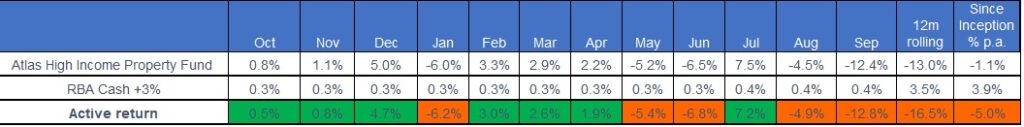

- The Atlas High Income Property Fund fell by -12.4%, a fall based on global macroeconomic fears rather than any issues with the companies held in the Fund. In August, the companies owned in the portfolio increased their dividends on average by +13%. On average, the companies that populate the Fund have gearing of 22%, have a 3% cost of debt with an average length of 5.5 years, have revenues linked to inflation and enjoy a 98% occupancy rate.

- The Fund declared a quarterly distribution of $0.028 per unit for the September Quarter. The distribution was paid to investors late last week.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2023