- September was a weak month, with global bond yields rising to Global Financial Crisis levels driven by macroeconomic concerns around higher interest rates and oil prices. This saw global stock markets uniformly fall between -3% and -5%. There were also few places to hide in Australia Listed Property, which fell -9% on concerns for rising interest rates reducing profitability for property and infrastructure assets.

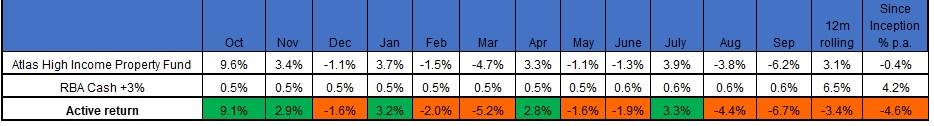

- The Atlas High Income Property Fund pulled back by -6.2%, a fall based on global macroeconomic fears rather than any specific issues with the companies held in the Fund. In aggregate, the companies held in the Fund have an average occupancy rate of 99%, with lower gearing, lower interest costs and a longer tenor of debt than the wider Australia Listed Property index. Despite this, the companies held by the fund trade at an average discount to net assets of -19%, with this net asset value backed up by actual transactions in the direct property market.

- The Fund declared a quarterly distribution of $0.027 per unit for the September Quarter. The distribution was paid to investors earlier this week.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2024.