- April saw a recovery in the property market as new cases of COVID-19 (CV-19) slowed rapidly in Australia and the state governments, towards the end of the month announced some relaxations to the social distancing rules and the path to reopening the economy. Government programs such as the Code of Conduct for Commercial Tenancies have provided landlords with a mechanism for sharing the impact of falling sales by deferring rents, very different to the fear prevalent in March that rental income would go to zero.

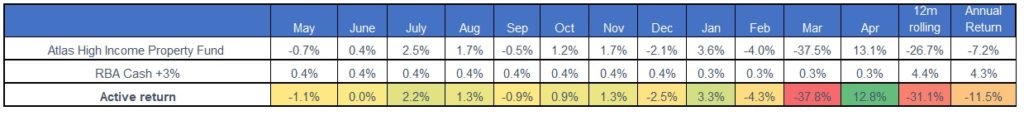

- The Atlas High Income Property Fund gained +13.1% reversing a proportion of March’s losses. Over the month, several holdings in the portfolio gave trading updates that indicated that their businesses were trading in-line with expectations given in February, with their tenants facing minimal impacts from CV-19 or in the case of supermarkets, chemists and liquor stores had seen increased turnover.

- Unlike companies such as the banks, property trusts cannot retain earnings for a rainy day and have to distribute profits each year. The Fund has a strong focus on non-discretionary retail, and we expect that the June distributions from the underlying holdings will be ahead of meagre market expectations, especially as the economy emerges from the lock-down.

- Human beings have consistently congregated in public places for shopping, dining and work since the Agora was built in Athens during the Fifth Century BC, it is hard to make the case that CV-19 permanently changes this pattern of human behaviour.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2020.