For much of the last decade, analysing the profit results for the banks was relatively straightforward. Coming out of the GFC the major trading banks steadily grew profitability on the back of solid credit growth, declining bad debt charges, and reduced competition as foreign competitors either exited the Australian market or was taken over. This changed with the Royal Commission on Financial Services in 2018, which had bank executive wringing their hands over remediation provisions and increased compliance costs during the profit results presented in 2018 and 2019. After CBA’s solid result in February 2020, this year was seen as the year when banking got back to normal; how wrong we were. I suspect that bank management teams would prefer being raked over the coals under the stern gaze of Commissioner Hayne, then in 2020 wondering whether a $1.5 billion provision for bad debts stemming from Covid-19 shutdowns will be enough?

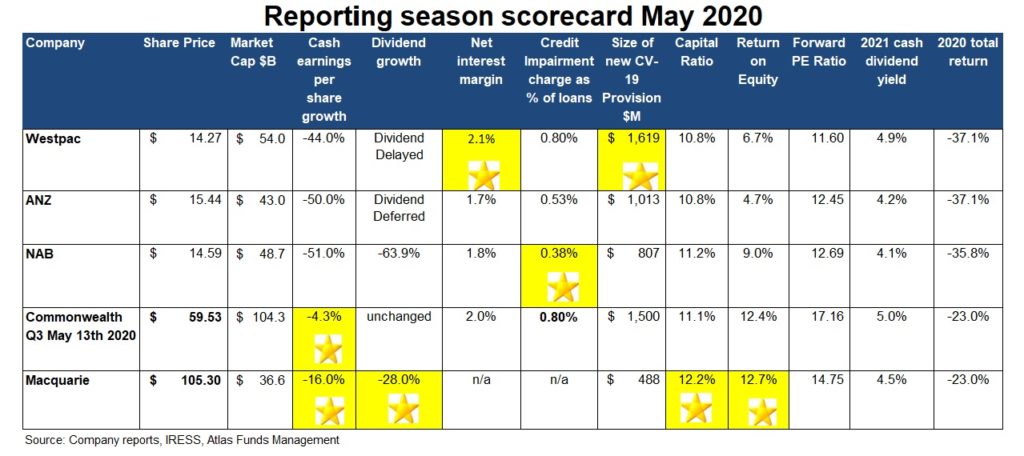

In this piece, we are going to look at the themes in the approximately 800 pages of financial results released over the past two weeks, including Commonwealth Banks 3rd Quarter Update that came out on Wednesday morning. We will award gold stars based on performance over the past six months.

Uncertainty

Uncertainty was the key theme for the May results, with the banking sector making guesses as to the impact that rising unemployment might have on both house prices and more importantly, bad debts. Significant rises in business failures drive higher unemployment, which makes it difficult for stressed consumers to service mortgage and credit card debts. Previous downturns such as 1982/83, 1991 and 2009 were quite different from what we have seen in 2020. In the past unemployment rose gradually, allowing the banks some time to adjust their risk settings. The Covid-19 related shutdowns in the economy, by contrast, will likely see unemployment move from 5.2% in March to a number close to 8% when the ABS releases April’s unemployment rate on Thursday, with unemployment heading to over 10% by June. The reported unemployment rate is likely to be understated because of the JobKeeper Program. This dramatic step-change in economic activity would have been outside any of the banks’ stress tests.

Due to a timing issue, the banks reported profit results up until the 31st March. Therefore, these results capture at most two weeks’ worth of closures, omitting a significant period of impact. Similarly, the outlook statements issued over the past two weeks contain a degree of guesswork as to what the likely impairment changes will be over the coming year, a judgement that will determine the size of the Covid-19 provision for bad debts. NAB has taken the lowest provision, which would typically get it the gold star, but in the current environment, there are no prizes for being too optimistic. The market would prefer to see a provision written back rather than new provisions raised at the full-year results in October. Interestingly, the two banks with the biggest exposure to mortgages (CBA and Westpac) have taken the largest provisions, despite historically loan losses from mortgages being quite small. ANZ and NAB have greater exposure to business banking which tends to incur higher losses, but both have taken lower loan loss provisions.

Gold Star

Capital

All banks have Tier 1 capital ratios above the Australian Prudential Regulation Authority (APRA) “unquestionably strong” benchmark of 10.5%, despite the billions of dollars of provisions taken and, in the case of Westpac, a billion-dollar provision for an AUSTRAC fine. This allowed Australia’s banks to enter 2020 with a greater ability to withstand an external shock than was the case in 2006 going into the GFC. For example, in 2006 Westpac had a Tier 1 Capital Ratio of 6.8% as compared to 10.8% today, even after taking into account the $3 billion in provisions taken in May.

In the May results, there was plenty of self-congratulation from bank managements at their prudence for having such high levels of capital in 2020, allowing the banks to respond to Covid-19 from a position of strength. However, in our view, this is due to a combination of luck and pressure from the regulator: APRA (Australian Prudential Regulation Authority). APRA mandated in 2015 that the bank increase the capital held such that they would be “unquestionably strong and have capital ratios in the top quartile of internationally active banks”. This saw Australia’s banks raise $20 billion in capital, an approach that was unpopular at the time with both investors and bank management teams, and was considered excessively heavy-handed by APRA.

Furthermore, both ANZ and Commonwealth Bank sold their wealth management and insurance businesses between 2017 and 2020, which generated billions of excess capital. The capital was expected to have been returned to shareholders in 2019, but this was derailed by the fall-out from the Hayne Commission. NAB’s slow moves to sell MLC saw the bank raising $3.5 billion in late April at a price that was dilutive for existing shareholders. Macquarie comes out ahead of the trading banks, but this is due to the differences in the business model of the global investment bank that has seen lower loss provisions as well as an opportunistic capital raise conducted in mid-2019.

Gold Star

Dividends

Given the current level of uncertainty, the banks cut and suspended their dividends in May 2020 with encouragement from APRA. The latter announced that it expected “prudent reductions in dividends” during the crisis. Given the uncertainty facing bank boards as to the impact of Covid-19, ANZ and Westpac opted to defer their first half 2020 dividends and wait until August to determine whether a payment will be made. This caution reflects the timing of the decision in late April, with increases in bad debts yet to impact bank profits.

Westpac and ANZ could have paid a dividend underwritten by an investment bank, but this would not have been in the long-term interests of shareholders. An underwritten dividend would have seen the investment bank selling newly issued shares on market throughout May to pay for the dividend, thereby diluting existing holdings and putting further pressure on the share price. NAB paid a 30c dividend in May, which was an exercise in financial gymnastics as it was coupled with a capital raising, which saw investors give NAB capital which was immediately returned. CBA’s dividend in February was unchanged, but we would expect a cut in August depending on the trajectory of bad debts. However, the sale by CBA of a 55% stake in Colonial for $1.7 billion is likely to allow the bank breathing room to pay a dividend in August. Macquarie cut their dividend but had a dividend payout ratio of 56%, which is well below their target range of between 60-80%.

Gold Star

Falling Net Interest Margins?

Last year the theme that was expected to dominate the bank results in 2020 was falling net interest margins. We are sure that compared to what bank management teams are actually facing in 2020, this now seems to be an issue of little significance. Banks earn a net interest margin [(Interest Received – Interest Paid) divided by Average Invested Assets] by lending out funds at a higher rate than that at which they can borrow these funds, either from depositors or on the wholesale money markets. The collapse in Australian interest rates in 2019 and increased competition for lending was expected to see the banks struggle to maintain net interest margins in 2020.

The May 2020 reporting season saw net interest margins remain stable at between 1.7% and 2.1%, with the banks more heavily exposed to mortgages (CBA and Westpac) traditionally having higher margins than the business banks (NAB and ANZ). The Covid-19 crisis has seen many borrowers in particular corporations increase their loans to ensure that they had liquidity on hand, particularly in March 2020. ANZ, for example, saw a $29 billion increase in their corporate loan book commenting that a significant proportion of these new loans taken out were immediately put on deposit with the bank. Here we observe some management teams are using the playbook they used to combat the GFC crisis, where cash was king during a period where frozen financial markets halted bank lending. This does not appear to be the case in 2020, as we are facing a biological, in addition to a financial and social crisis.

Additionally, these new loans are being priced at higher rates than the existing loan book, which has supported the banks’ net interest margin. Going forward, we would expect loans to be repriced upwards when they come up for renewal, based on the banks’ pricing for higher levels of bad debts.

Gold Star – Australian banking oligopoly

Our Take

What to do with the Australian banks is one of the major questions facing both institutional and retail investors alike, as their share prices have fallen significantly in 2020 and they appear priced for the most pessimistic outcome. The remainder of 2020 will undoubtedly be tough for the Australian economy, but a big difference between the CV-19 crisis and previous crises has been the speed and size of the fiscal responses to CV-19. During the GFC, it took around 12 months for the politicians to respond to the unfolding crisis, mainly due to the impression that those most affected were bankers and US sub-prime borrowers.

In 2020 our political masters can see that the virus impacts voters. During the GFC peak stimulus spending in Australia accounted for around 1.8% of GDP, in 2020 the announced measures represent 9.5% of pre-crisis GDP. These measures will soften the impact on loan losses from the banks as stimulus payments flow into the economy. While the outlook for the banks looks uncertain, Australia’s banks have historically performed well coming out of crises that have reduced foreign competition and allowed them to absorb second-tier domestic banks. The threat posed by neo banks in 2019 may well recede as the CV-19 inspired “flight to quality” sees Neo bank deposits switch back to the major banks, at a time when losses on the neobank loan books are increasing.