- October was a tough month for investors globally with equity indices down between -5% and -10%, driven by concerns over higher interest rates and declining global growth. In this broad-based market correction, listed property held up relatively well with the ASX200 A-REIT declining “only” -3.1%, far better than the ASX 200 that fell-6.1%.

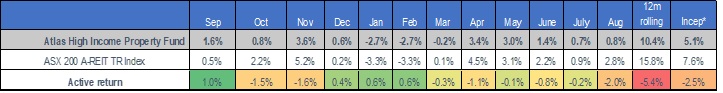

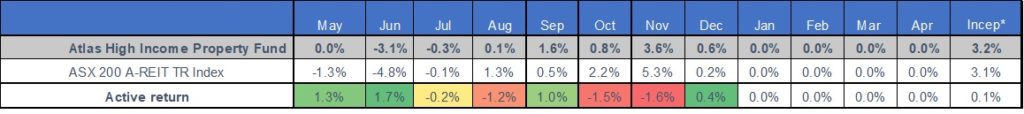

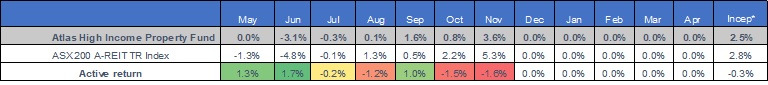

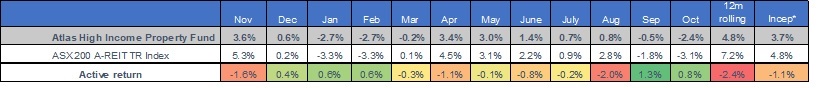

- The Atlas High Income Property Fund declined by -2.4% in October, with share price falls were cushioned by gains in the value of the put options owned by the Fund and the position in SCA Property (+7%) that defied the prevailing market gloom.

- October was a month where fear was the dominant emotion and the market ignored some very positive quarterly updates from the retail and office trusts which showed sales growth in the nation’s shopping centres and strong demand for office space. Indeed GPT (-1%) declined despite the trust upgrading profit and distribution guidance for the year.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2019.

Lendlease is similar to Goodman Group in that it has experienced internal development capability and strong capital partner relationships which help it build its other arm: funds management, where it earns fees on performance and management of billions of dollars worth of property. Growth in funds under management was 15 per cent to $30.1 billion in fiscal 2018. But how sustainable is that growth? And will all this be enough when the commercial property cycle changes? When interest rates rise and when property valuations and volume transactions fall away?

Lendlease is similar to Goodman Group in that it has experienced internal development capability and strong capital partner relationships which help it build its other arm: funds management, where it earns fees on performance and management of billions of dollars worth of property. Growth in funds under management was 15 per cent to $30.1 billion in fiscal 2018. But how sustainable is that growth? And will all this be enough when the commercial property cycle changes? When interest rates rise and when property valuations and volume transactions fall away?