JB Hi-Fi could buck the broader retail trend in a tough year ahead

There are good reasons to believe JB Hi-Fi (ASX: JBH) will buck the trend in what will almost certainly be a tough year for the consumer discretionary sector. That’s according to Hugh Dive of Atlas Funds Management. JBH is one of Australia’s top 10 retailers in terms of market cap.

Category: Uncategorized

AFR: Is CSL a $300 stock? Fundies unpack its world-class valuation

January Monthly Newsletter

- In January, the “Santa Claus” rally came late investors globally shrugged off the concerns that dominated December, namely a recession in the USA and rising inflation. The benchmark 10-year bond rate fell 0.5% to 3.55% based on the

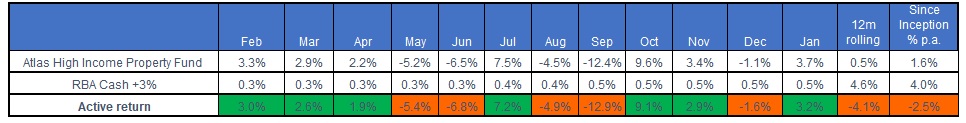

assumption that central bank rate tightening was ending. This saw the more speculative equities and listed property trusts rally in January. However, these same companies saw their share prices fall in early February, with the US Federal Reserve and the RBA raising rates! - The Atlas High Income Property Fund had a solid month gaining +3.7% and erasing December’s falls. Whilst pleasing, share prices in December and January always move with vague macro-economic fears and greed, not actual earnings,

as they trade in a vacuum with company management teams precluded from speaking to the market before releasing their financials in February. - Atlas is looking forward to the February profit season, which we expect will show both the resilience of company earnings from the companies held in the portfolio and that management will guide to higher distributions through the rest of 2023.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2023.