In October each year, listed Australian companies with a June financial year end host their annual general meetings (AGMs). Fund managers rarely attend these events as they are designed to allow retail investors to pose questions to company management and vote on directors and the company’s remuneration report. Institutional investors do not vote in person but rather by instruction to the custodians holding their fund’s shares. They would have met with company management in August when they released their financial results.

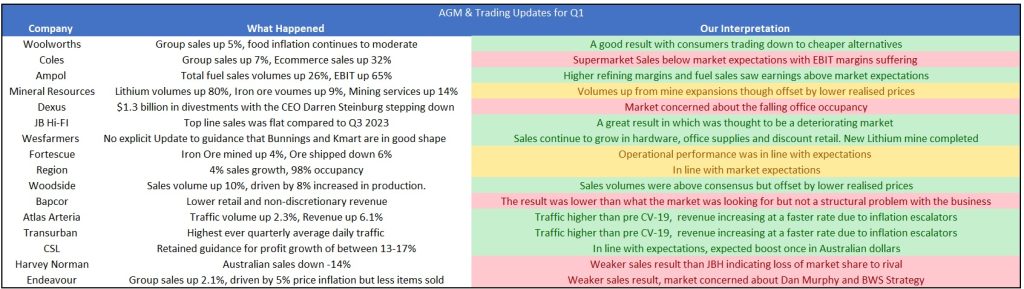

In this week’s piece, we will look at the quarterly trading updates given by a range of Australian companies to try and piece together what is going on in the Australian economy. While the broad-based fall in share prices since mid-September suggests that companies are struggling, the quarterly updates showed robust trading conditions for many Australian companies.

Normally, we don’t pay much attention to AGM’s and the trading updates given by management are usually very similar to the conditions the company was facing in August.

However, this October has seen greater interest in company updates at the AGMs due to the sharply changing economic conditions. Over the last 18 months, the average mortgage rate has increased from 2.14% to 6%, along with cheap fixed-rate mortgages converting into higher variable rates dubbed the “fixed rate cliff” by the media. This should have seen cratering retail sales in 2023 and significant falls in house prices, neither of which have occurred. Additionally, increases in inflation of the same period have posed challenges for many companies.

Consequently, Atlas has been looking closely at management presentations over the past two weeks at company AGMs. While some companies are exhibiting signs of weakness, the October updates showed that many Australian companies are navigating the changing environment quite well.

Retail Mixed

The non-discretionary grocers had a good start to their years, with Woolworths and Coles posting sales growth of over 5% for the first quarter. The grocers both mentioned that food inflation is moderating in late 2023 to between 2-3%, with the prices for some items such as fruit, vegetable and packaged meat now falling. Higher interest rates have seen shoppers trading down to cheaper home brand items, which deliver a higher profit margin, with Woolworths citing an 8% increase in home brand sales. Liquor retailer Endeavour saw modest sales growth at BWS and Dan Murphy’s of 1.8% and, like the grocers, experienced value-conscious customers trading down to mainstream beer and lower priced rosé and pre-mixed drinks.

JB Hi-Fi’s first quarter was much better than expected, with Australian sales falling -1.4%, cycling off a very strong first quarter last year. Conversely, electrical goods rival Harvey Norman saw Australian sales falling by -14% but announced a surprise $440 million on market buy-back as a salve for investors. Atlas’ calculations indicate that the company will be borrowing to buy back their shares, an aggressive move from an already highly geared company in a market with rising interest rates and weakening retail sales. JB Hi-Fi appears to be benefiting from their lower cost business model, which has seen them take market share off Harvey Norman.

Wesfarmers produced a fantastic first-quarter result, demonstrating that consumers are still willing to spend money and trade down to lower-cost products across their offerings. We see that Bunnings and Kmart, the lowest-cost operators across the hardware and discount department store markets, will continue to benefit and take market share over the short-medium term.

Miners facing cost inflation

The iron ore producers had in-line first quarters and are continuing to benefit from higher iron ore prices but will face headwinds over the coming months and years. BHP, Rio Tinto, and Fortescue are all facing inflationary problems, with higher oil prices set to be higher for longer and ongoing labour costs, which will increase production costs. We remain cautious towards the iron ore producers due to concerns about the sustainability of iron ore prices above US$100/t in the face of a slump in Chinese residential construction and a government plan to cap steel production at 1 billion tons per annum.

Energy powering ahead

Woodside Energy had a solid quarter, with production up +8% to 48 million barrels of oil. The company also announced that they had started producing at a new field in the Gulf of Mexico, which was six months ahead of expectations which saw full-year guidance being upgraded. Woodside has little exposure to a weakening Australian consumer, selling energy into a global market primarily via long-term off-take agreements to utilities in Japan, China and Korea. Stronger energy prices in the latter part of 2023 and a weaker Australian dollar are setting Woodside up for a strong finish to the year. Similarly, oil refiner and petrol retailer Ampol released a stellar quarterly update in October, showing that profits were up +65% on the previous quarter. The company continues to benefit from higher fuel sales, strong margins from refining crude and, surprisingly, an increase in convenience retail sales. We had expected a big fall in convenience retail sales for Ampol due to higher petrol prices, but motorists are still buying Gatorades, Mars bars and Guzman y Gomez burritos after filling up!

Toll Roads Stronger than Ever

After the Ampol quarterly that showed Australian fuel sales were up +11%, it was not a great surprise to see the toll road operators report strong traffic numbers in October. Transurban reported record quarterly average daily traffic across their network with 2.5 million trips per day, with traffic up +3% on the prior period. Similarly, Atlas Arteria saw traffic up +2.3% in the past quarter, mainly in their French assets, with revenue up a healthy 6.1%. Due to the impact of quarterly escalators on their inflation-linked tolls and long-term fixed-rate debt, higher traffic will see expanding profit margins.

Healthcare robust, but weight loss Fears Dominate

The past quarter has been tough for investors in healthcare stocks, with the dominant theme being concerns that GLP-1 weight-loss drugs will impact demand for a range of therapies treating sleep apnea, cardiovascular diseases and kidney damage. Indeed, these weight loss drugs have even impacted the share prices of pathology testing companies under the assumption that a potentially slimmer society will result in fewer oncology, fertility, gastrointestinal and respiratory tests.

Resmed has seen its share price hit the hardest, losing a third of its market capitalisation due to the view that slimmer patients will see diminished demand for sleep apnea devices. While this may occur in the future, Resmed’s quarterly update showed revenue of +16% and profits up +9%. Similarly, CSL’s share price has been under pressure due to the unproven potential of the GLP-1 weight-loss drugs on the company’s kidney disease treatments, despite dialysis comprising a small part of company earnings. At their annual capital markets day in October, CSL revealed that the company was trading strongly and confirmed guidance for profit growth in 2024 between 13-17%.

Out Take

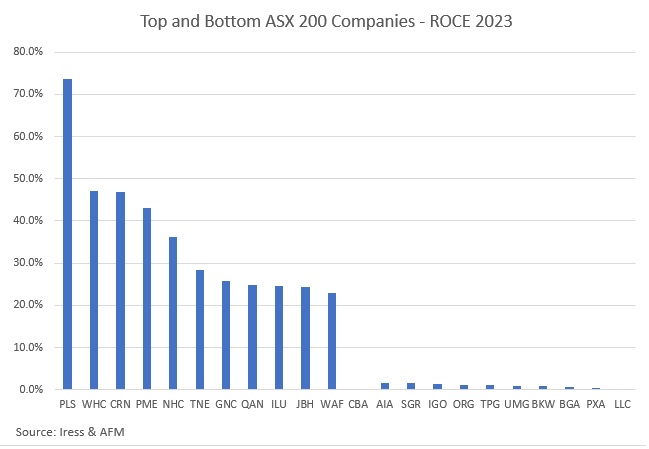

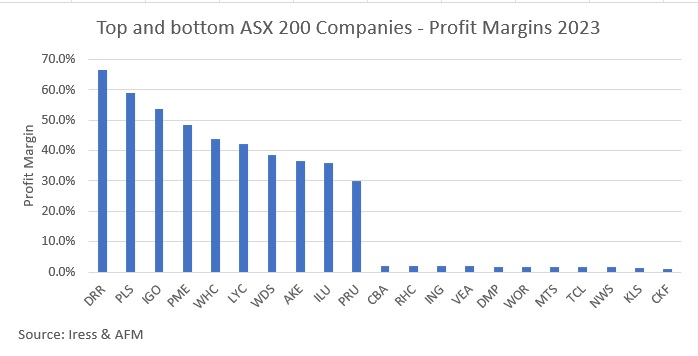

Global equity markets have fallen by close to 10% over the last three months, and at the close of October 2023, many companies on the ASX200 are trading near or even below the lows of March 2020 despite having better business operations and higher profits in 2023. Toll road operators Transurban and Atlas Arteria are trading at a 25% discount to their pre-COVID share price despite higher traffic volumes and toll prices. Similarly, healthcare companies Sonic Healthcare and CSL both have share prices below January 2020 despite having higher earnings per share and servicing more customers worldwide. While some companies will struggle in an environment where money is no longer free or falter due to higher geopolitical tensions, for many companies, these factors will have limited to no impact on corporate profits and distributions to their shareholders.

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine” – Warren Buffett.