- July saw a volatile month for listed real estate, with the sector up in the first half buoyed by the majority of property trusts paying a distribution in late June and improving retail sales data. However, these gains were reversed on news of rising CV-19 cases in Victoria that ultimately resulted in a lock-down in the southern state.

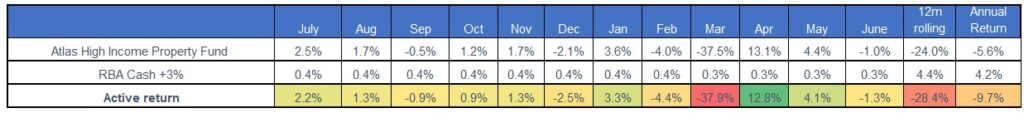

- The Atlas High Income Property Fund declined by 2.4% during July, a frustrating outcome as most of the month the Fund was ahead of both the index and in positive territory prior to a sell-off on the last two trading days of the month.

- The last six months have seen very negative sentiment towards real estate and a wider-spread de-rating of the sector. While discretionary retailers face a tough outlook; the largest exposures in the Fund are to supermarkets, industrial and infrastructure real estate, assets that have seen either minimal or even slightly positive impacts from CV-19. In late June, 85% of the Trusts in the portfolio that were due to pay a distribution did so, with one deferred to August. This indicates that high levels of rent are being collected and that not all businesses in 2020 are facing the same challenges.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2020.