Global equity markets staged a recovery in March, though Australia lagged global markets due to falling bond yields and weakness in Chinese equities based on concerns about a stalling recovery in the Middle Kingdom. Domestically the negative impact of a lockdown in Queensland was offset by falls in the unemployment rate and rising house prices.

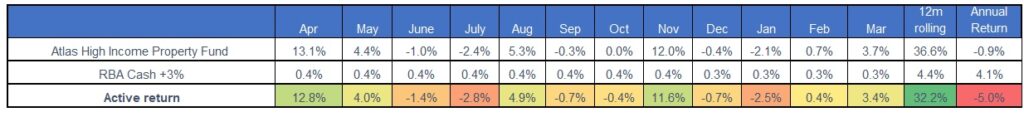

The Atlas High Income Property Fund had a solid month gaining +3.7%, continuing to recover from the dark days of March 2020, when sections of the media questioned whether we would ever return to offices, shopping centres and toll roads. While most of the listed property sector’s share prices remain below where they were trading in February 2020, the lowly geared rent-collecting trusts that populate the portfolio are in good financial shape, collecting rents and paying distributions.

The Fund declared a quarterly distribution of $0.032 per unit. The distribution will be paid to investors in early April.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2021.