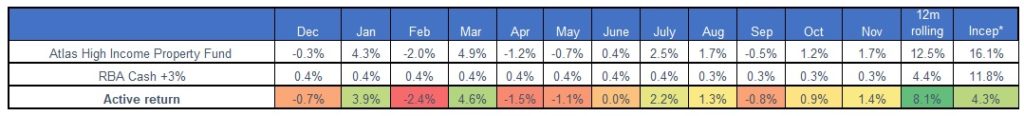

- The Atlas High Income Property Fund had a solid month in November gaining +1.7%.

- On Melbourne Cup Day the RBA met and decided to hold the cash rate at 0.75%, waiting to see whether previous rate cuts and $22 billion in tax refunds have boosted consumer spending and kept the unemployment rate in check. However, in his speech, the RBA Governor paved the way for further interest rate cuts in 2020.

- The Fund remains populated with trusts with recurring earnings streams from rental income from long-dated leases to high-quality tenants. Due to leases that mostly provide for fixed price rental increases above the current of inflation, in the medium term, we expect steady growth in the distributions that the Fund is receiving from our investments.

Go to Monthly Newsletters for a more detailed discussion of the listed property market and the fund’s strategy going into 2020.