The first two months of 2018 have been a wild ride for Australian shares, with big falls and then big recoveries. However, from looking at the headlines in the financial press most investors would be surprised to find out that the ASX 200 index actually finished February exactly where it started the year.

Last week we looked at the causes behind the volatility in February – Volatility and Melting Markets – and in this week’s piece we are going to look at how we approach market dislocations.

Surviving previous crashes

Surviving previous crashes

In my funds management career, I have had the “fortunate” experience of having observed both the GFC in 2007-08 and the Tech wreck in North America in 2001 from the front lines, helping to manage large institutional equity funds when the prices of all stocks regardless of their quality were falling heavily. During both of these crashes, I worked with firms that ran conservative value-style funds, based on fundamental analysis of companies.

During these periods the portfolios were populated with companies paying dividends from stable recurring earnings such as TransCanada Pipelines and Amcor. These portfolios had no exposure to companies that were reliant on the previous frothy market conditions continuing such as Pets.com, Nortel, Babcock & Brown, or Allco Finance. What I learned from these experiences is that a portfolio constructed in a conservative manner populated by companies paying stable and growing dividends with low gearing will bounce back from the blackest nights of doom and gloom.

Know when to hold them

In a perfect world, investors with perfect knowledge would head into a major market meltdown having sold all equities would have a 100% cash weight. However practically that would never happen due to both taxation consequences and the risk that the call may be very premature or even wrong. Many investors may remember RBS’s advice in January 2016 to sell everything as oil was going to $15 a barrel and equities markets were going to fall by 20%. Consequently investors and fund managers only tend to have hard looks at their portfolios when the bull market stops and stock prices are falling.

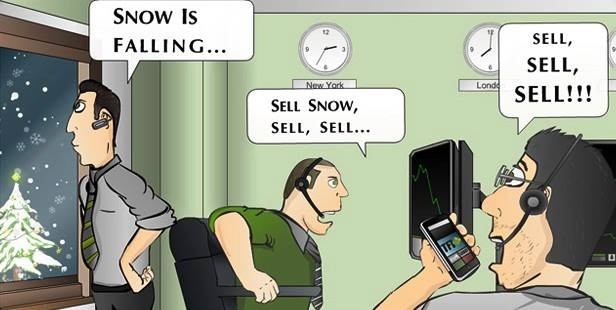

In our opinion the worst thing that investors can do is look at the sea of red on your computer screen for hours at a time, or read the some of the breathless market commentary in the financial press or coming out of the trading desks at the investment banks. The former is designed to sell newspapers and the latter is produced in an attempt to influence you to incur brokerage, when doing nothing may be the best option.

When a major market dislocation occurs, the best thing for investors to do is step back and think what this particular dislocation will do to the earnings and dividends from the companies held in their portfolio. If the answer is not much and the dividend stream will be largely unaffected, then the falling market has given you the opportunity to add to positions at a discounted price. For example, it was hard to see how the falls in the US market in February were going to impact rental income from SCA Property’s portfolio of neighbour shopping centres, or Amcor’s sales of PET soft drink bottles and flexible food packaging.

Know when to fold them/ know when to walk away

Conversely, companies in an investor’s portfolio that rely on benign debt and equity markets to finance their growth or are still proving up their business model should be looked at with the most critical of eyes. These companies are typically characterised as “concept stocks”. Often they are companies with exciting technologies in new markets that may have significant future value, but are often have minimal current earnings and assets that could help them weather the inevitable storms. Recent examples of high growth concept stocks that have run into trouble include GetSwift and BigUN.

Amongst the larger stocks on the ASX, investors should look critically at companies with both high PE ratios, high gearing or those that have recently made significant acquisitions. During major corrections, companies with these characteristics tend both to get sold off the most, and might also face dilutive equity raisings due to pressure from their bankers.

All weather stocks

Whilst listed property trusts as a sector are viewed with suspicion by many investors at the moment we continue to like SCA Property. This trust is exposed to domestic food, liquor and services consumption via long-term leases to Woolworths. During major market meltdowns such as the GFC, consumers tend to cut back spending on discretionary items such as clothes and going out to restaurants in favour of cooking and drinking (larger than normal) glasses of shiraz at home, all of which are supportive for SCA Property’s earnings.

Woolworths’ landlord continues to benefit from the supermarket giant’s battle to regain market share from Coles, as a portion of the rent is tied to turnover. The trust is conservatively run by an experienced and honest management team and importantly has low gearing and minimal near-term debt maturing. In February management upgraded profit guidance for 2018, yet the trust is trading on a yield of 6.3%.

Current Positioning

In the current environment Atlas see that investors should be looking through their portfolios for the stocks that could “torpedo” portfolio performance. In early 2018 rather than scouring the market for the next Blackmores or A2M Milk, we are spending time thinking about what could go wrong with the various companies in our existing portfolios. As a quality style manager, we are spending time looking closely at the quality of company earnings and the percentage of earnings that are derived from recurring earnings that will hold up over time, rather than profits coming from revaluations, accounting changes, asset sales or performance fees.

In terms of sector positioning Atlas are very cautious on the mining sector, especially at the sexier end of lithium and graphite. The frenzied activity, promise and hype in this sector looks like a movie that I have seen before. Whilst the consensus view is that commodities will stay strong in 2018, a large part of the price moves we saw in 2017 was the result of Chinese stimulus plans enacted in 2016 which has begun to fade. Declining Chinese dependence on fixed-asset investment to drive growth will put downward pressure the prices of commodities such as coking coal, iron ore and copper.